5% Base Rate: Options To Maximise Your Mortgage

High interest rates and rising inflation mark the current mortgage landscape. These rates impact borrowers in various ways, especially those with variable or tracker mortgages or those seeking new fixed-rate deals, as they see higher monthly payments.

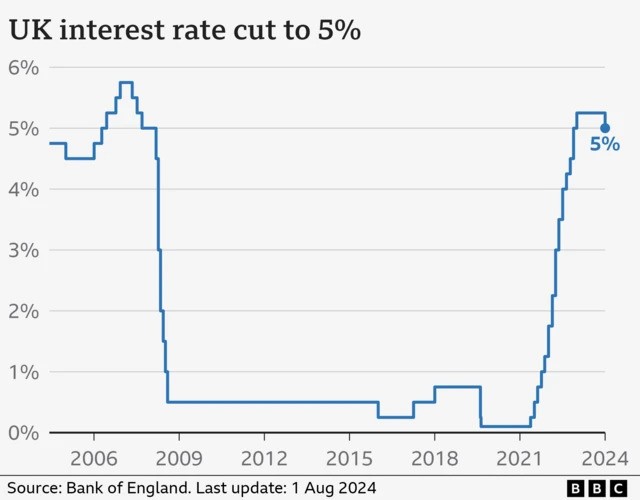

Meanwhile, first-time buyers face greater hurdles as securing affordable mortgages has become more challenging. With 1.6 million borrowers expected to reach the end of their fixed-rate deals this year, the timing of decisions on interest rates will likely play a significant role in determining affordable options. The UK base rate remains at 5%, reflecting the Bank of England's cautious approach to monitoring inflation trends to ensure stable prices.

Source: BBC.com

Is A Base Rate Reduction Coming Soon?

There is an estimated 80% likelihood that the Bank of England might reduce the base rate, which could directly impact mortgage rates. Although expectations have adjusted slightly, with inflation anticipated to increase following the recent budget announcement, lenders remain prepared to respond swiftly to rate cuts.

A recent trend has seen two-year fixed-rate mortgages gaining popularity over five-year fixed products. Following the Bank of England’s rate cut from 5.25% to 5% in August, analysis from LMS indicates that 44% of new borrowers opted for two-year fixed deals in September, while 42% chose five-year fixed products. This shift suggests that some borrowers may soon be betting on further rate reductions.

Two-Year Deals Are Now Outperforming Five-Year Options

Deciding between a two-year or five-year fixed rate depends on individual financial circumstances, as average five-year fixed rates currently sit lower than their two-year counterparts. Barclays recently attracted attention with rate reductions across its residential mortgage range, again offering sub-4% deals for two-year fixed options.

For those looking to optimize their mortgage choices in this high-rate environment, Revolution Brokers suggests several strategies:

- Consider Overpayments – If you’re still within a low fixed-rate deal, making overpayments now can reduce your balance more quickly, resulting in savings on interest and lower payments in the future.

- Switch to an Interest-Only Mortgage—This option can help manage monthly costs, as you’ll only pay interest without reducing the principal. However, keep in mind that this approach defers the total repayment, meaning the full mortgage balance will still be owed at the end of the term.

- Extend Your Mortgage Term—Increasing the mortgage term from 25 years to 30 or even 40 years can significantly reduce monthly payments, making them more manageable in the short term. However, this option will increase the total amount of interest paid over time.

Not sure how much you can borrow? Use our online mortgage calculator to find out!

Ways To Tackle Online Fraud

As part of our commitment to financial well-being, we’d also like to highlight the recent security concerns around online fraud, which can affect financial stability. With rising instances of scams facilitated through platforms like Facebook and Instagram, borrowers are urged to stay vigilant.

Nearly 80% of financial fraud in the UK occurs through the top tech platforms, with around 70% attributed to Meta’s platforms alone. This is why ensuring secure transactions and avoiding sharing financial details through potentially risky channels is essential.

Need more guidance on your next mortgage? Revolution Brokers can help you make informed decisions tailored to your financial situation. Whether you’re looking to secure the best rates, explore flexible mortgage options, or navigate high-interest challenges, our expert team is here to provide clarity and actionable strategies.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)