Guide To Using Short-Term Bridging Loans For Commercial Property Development

Finding quick funding for commercial property development can be tough. Loans start from £26,000 for this purpose. This blog explains how short-term bridging loans offer a solution.

Keep reading to learn more.

Key Takeaways

- Commercial bridging loans provide fast, short-term funding starting from £26,000 to 70% of a property's value, making them suitable for property developers who need quick access to capital.

- These loans come in various types including open and closed bridging loans, as well as first and second charge loans, each offering different benefits depending on the developer's circumstances and project timelines.

- Lenders offer these loans based on the value of the commercial property involved and often approve funds more rapidly than traditional finance options, with times ranging from just 3 days to no more than 3 weeks.

- Despite their flexibility and speed, commercial bridging loans carry higher interest rates compared to traditional financing methods—starting at 1.05% per month—which can lead to rapid debt accumulation if not managed wisely.

- When applying for a commercial bridging loan, it is crucial to select a reputable lender by researching their awards history and customer satisfaction ratings on platforms like TrustPilot or Feefo.

What is a Commercial Bridging Loan?

Moving on from the introduction, a commercial bridging loan stands as a short-term financing solution aimed at those involved in property development. This type of loan offers quick financial aid, allowing borrowers to cover costs until permanent funding gets secured or the property is sold.

Lenders offer amounts starting from £26,000 and can go up to 70% of a property's value. They are ideal for developers needing speedy access to funds.

Typically lasting for about 12 months, these loans present an alternative to traditional mortgages with their quicker arrangement times. Borrowers use them for various purposes including buying new properties quickly or funding essential pre-development work that cannot wait for longer-term finance options.

Key Uses of Commercial Bridging Loans

Commercial bridging loans serve crucial roles in the fast-paced world of property development. They offer quick financial support for buying properties and cover initial costs before bigger funding comes through.

Rapid capital for property acquisition

Securing rapid capital for property acquisition is a key use of commercial bridging loans. Investors find this option appealing due to the quick access to funds, enabling swift property purchases.

The process can wrap up in as little as 3 days but typically takes no more than 3 weeks. This speed makes it possible for buyers to act fast on prime real estate opportunities.

Lenders offer minimum loans starting at £75,000, making it easier for investors to jumpstart their ventures without delay. The expedited financing facilitates immediate capital availability, allowing for speedy transactions in the competitive real estate market.

This financial solution proves invaluable for those needing fast capital for commercial property acquisition.

Funding for pre-development costs

Funding for pre-development costs is crucial in commercial property development. Developers use short-term bridging loans to cover these expenses. These costs include surveys, planning permission, and design fees.

Bridging finance offers a quick solution to meet these upfront costs.

Bridging finance also supports limited companies, Channel Islands entities, and foreign nationals. The property must have over 40% commercial use to qualify. This flexibility makes it easier for developers to start their projects without delay.

Moving on to the various types of commercial bridging loans helps understand the options available.

Types of Commercial Bridging Loans

Different types of commercial bridging loans cater to various needs and situations in property development. Each type offers unique terms and conditions, making it vital for developers to choose the one that best fits their project goals.

Open Bridging Loans

Open bridging loans offer property developers great flexibility. They do not have a fixed repayment date, which makes them suitable for projects where the completion date might be uncertain.

Borrowers use these loans until they secure long-term funding or sell the property. This type of loan is ideal when you're waiting for approval on a commercial mortgage or selling another property to raise funds.

With an open bridging loan, interest rates might be higher due to their flexible nature. Developers should plan carefully to manage this cost effectively. Now, let's talk about closed bridging loans and how they differ from open ones.

Closed Bridging Loans

Shifting focus from open bridging loans, we explore closed bridging loans that come with a definite repayment date. These types of commercial property loans are ideal for borrowers who know exactly when they will have funds available to repay the loan.

Typically, this certainty comes from the sale of another property or the outcome of a financial event already in motion.

Closed bridging loans offer more favourable interest rates compared to open ones because the lender has a clear understanding of how and when they will get their money back. This form of bridge financing suits investors and developers involved in real estate projects who need short-term funding but can pinpoint when their investment will pay off.

First Charge Bridging Loans

First charge bridging loans secure against commercial property as the primary collateral. These loans give priority over any other finance secured on the same asset. Lenders prefer this type of loan because it reduces their risk, allowing for quicker decisions and funding release.

This kind of interim financing supports buyers who need to move fast in competitive markets.

Businesses often choose first charge bridging loans when purchasing new properties or securing initial development funds before longer-term finance becomes available. The loan's speed enables investors to take advantage of opportunities without delays.

As these are based on existing collateral finance, applicants must own a property that can act as security for the loan amount.

Second Charge Bridging Loans

Second charge bridging loans offer a means to borrow against a property already secured by another loan. This type of finance acts as an additional loan; it doesn't replace the primary mortgage but sits behind it in terms of repayment priority.

Property owners opt for second charge loans when they need further funding but don't want to refinance their existing first charge loan due to penalties or favourable terms they wish to retain.

These loans are secured, meaning the lender can claim the property if repayments aren't made.

Lenders provide these loans based on the equity available in the property, which is the value of the property minus any outstanding mortgage or other debts secured against it. Second charge loans can be quicker to set up than refinancing a whole mortgage, making them attractive for urgent financing needs like capital injections into businesses or covering short-term cash flow issues.

They carry risks similar to first charge bridging loans, including higher interest rates and potential for debt escalation if not managed properly.

Benefits of Commercial Bridging Loans

Commercial bridging loans offer great flexibility, making it easier for businesses to meet their unique financial needs quickly. They provide rapid access to funds, ensuring that property developers can move forward without delay.

Flexibility in lending criteria

Lenders of commercial bridging loans often base their decisions on the value of the property. This flexibility means a wider range of properties can secure funding, including those that might not meet traditional lending criteria.

Without early repayment charges, borrowers have more control over their finance strategy. They can repay the loan as soon as they secure long-term financing or sell the property.

This approach to lending offers significant benefits for developers and investors in commercial real estate. They enjoy flexible loan decisions and avoid penalties for paying off their debt ahead of schedule.

The focus on property value allows for quicker, more adaptable financing solutions based on tangible assets rather than just credit history or income levels.

Quick access to funds is another crucial advantage awaiting discussion.

Quick access to funds

Commercial bridging loans offer the advantage of fast funding solutions, crucial for developers facing tight deadlines. Typically, these loans can be arranged far quicker than traditional mortgages, with completion times ranging from just 3 days to 3 weeks.

This rapid access to capital allows businesses to move swiftly on property acquisitions or development opportunities without the lengthy wait associated with other forms of financing.

Securing quick approval for business loans through commercial bridge financing means investors can leverage speed as a strategic advantage in competitive real estate markets. The next heading will explore short-term financial solutions offered by commercial bridging loans.

Short-term financial solution

Gaining quick access to funds naturally leads to the advantage of a short-term financial solution that bridging loans provide. With loan terms typically between 1 and 18 months, businesses can benefit from bridge financing as a swift way to secure capital.

This flexibility allows for immediate business funding without the long wait times associated with traditional loans. Bridging loans serve as an effective temporary business loan option, offering fast commercial funding when time is of the essence.

Such prompt financial support ensures that companies can move forward with commercial property developments or acquisitions without unnecessary delays, making it an ideal solution for those in need of short-term capital solutions.

Risks and Considerations

Taking out short-term bridging loans for commercial property development comes with its own set of risks. Lenders charge higher interest rates than you would find with traditional loans, and if not managed carefully, the debt can quickly spiral.

Higher interest rates than traditional loans

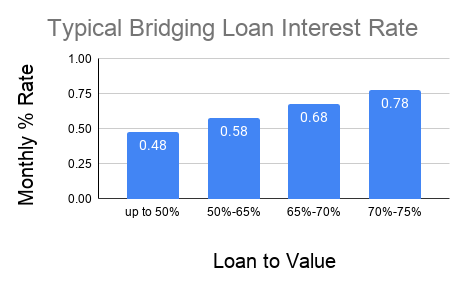

Commercial bridging loans come with higher interest rates compared to traditional loans. Rates often start from 1.05% per month. This makes the cost of borrowing more expensive over time.

Lenders charge these elevated rates due to the short-term nature and flexibility of the loan. Borrowers should assess their ability to manage these costs before proceeding. Next, we will explore the potential for rapid escalation of debt in this context.

Potential for rapid escalation of debt

Borrowers often face the risk of rapid debt growth with commercial bridging loans. High interest rates and potential financial burdens come into play quickly if they do not repay on time.

This can lead to an accumulation of debt faster than one might anticipate.

Lenders assess creditworthiness before offering a loan, but terms are not regulated by the Financial Conduct Authority. This means borrowers must understand their financial obligations clearly.

Unregulated loan terms contribute to the unpredictability of debt escalation, making it a key risk to consider.

How to Apply for a Commercial Bridging Loan

To apply for a commercial bridging loan, start by checking if you meet the eligibility criteria set by lenders. Then, select the most suitable lender for your needs and prepare to submit your application.

Understanding eligibility

You need to check if you meet the eligibility criteria before applying for a commercial bridging loan. Lenders will look at your creditworthiness and assess the property you are planning to buy or develop.

The key requirement is that the property must be used more than 40% for commercial purposes. They also perform a detailed assessment of your business finance health and project feasibility.

Your application process involves submitting documents that prove your claim on the property’s commercial use percentage and your ability to repay the loan. Credit checks form a crucial part of this process, as they give lenders insight into how reliably you've handled debt in the past.

Meeting these requirements boosts your chances of loan approval considerably.

Choosing the right lender

Selecting the best lender for a commercial bridging loan involves research. Look at lenders who have won awards, such as being named Bridging Lender of the Year in 2021 and 2023. This shows they are recognised by peers and clients for their service and products.

Reviews also matter greatly. A lender with over 1,400 TrustPilot reviews averaging above 4.5 stars demonstrates reliable satisfaction among borrowers.

Feedback on Feefo is equally important, where more than 1,900 reviews averaging above 4.5 stars indicate high levels of customer trust and satisfaction. These metrics help in making an informed decision about which lender can offer the right commercial property loan terms that meet your specific short-term financing needs.

Next, let's look into how to apply for a commercial bridging loan effectively.

Conclusion

Short-term bridging loans offer a quick and flexible way to finance commercial property development. They allow businesses to act fast on opportunities with funding that's more accessible than traditional loans.

With options for different types of properties and competitive rates, these loans present a valuable tool for developers needing rapid capital. It's crucial to understand the risks, such as higher interest rates, but with careful planning, bridging finance can be an effective solution for short-term property investment needs.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)