Buy To Let Mortgage For First-time Landlords With Low Deposit

Finding the right mortgage can seem like a maze for first-time landlords, especially when you have a small down payment. A low deposit buy-to-let mortgage requires just 15% upfront, making property investment more accessible.

This article will guide you through getting one of these mortgages, from understanding eligibility criteria to managing the costs involved. Let's start your journey to becoming a landlord.

What is a Buy-to-Let Mortgage?

A Buy-to-Let Mortgage lets you borrow money to buy a property that you can rent out. It's different from a loan for your own home because it treats the house as an investment, not just a place to live.

Differences from residential mortgages

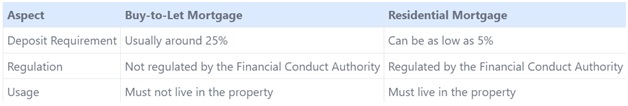

Buy-to-let mortgages differ from a residential mortgage in several key areas. Below is a table outlining these differences:

This table highlights the main differences, including the higher deposit needed for buy-to-let mortgages and the regulation by the Financial Conduct Authority. Living in a residential property with a buy-to-let mortgage breaches the mortgage agreement. These factors are crucial for first-time landlords to understand before entering the buy-to-let market.

Benefits for first-time landlords

First-time landlords have a favourable opportunity to begin gaining from property investments with a buy-to-let mortgage. They have options between repayment or interest-only mortgages, offering them adaptability based on their financial position.

With only a 25% deposit necessitated, this widens the market for those who may not have large amounts of capital but are eager to invest in the rental market. These mortgages permit first-time buyers to enter the property ladder as investors, potentially culminating in substantial rental income.

Choosing a buy-to-let mortgage also enables first-time landlords to reap the benefits from current interest rates and terms exclusively crafted for rental properties. This customised strategy aids in managing borrowing costs effectively while aiming for profit through tenants' rent monthly mortgage payments.

It's an efficient method for new investors to step into the housing market without the substantial initial financial pressure typically associated with purchasing a property outright.

Obtaining a Low Deposit Buy-to-Let Mortgage

Getting a mortgage for buy to let with a small down payment is possible. First, check if you meet the basic conditions set by lenders.

Eligibility criteria

Securing a buy to let mortgage permits first-time landlords to venture into the property market. Applicants are required to fulfil specific eligibility criteria defined by mortgage lenders.

- Age requirement: Applicants are required to be over 18 years old to apply for a buy to let mortgage.

- Income sources: Lenders accept diverse income sources including employment, properties, and pensions, facilitating the process for those with limited personal incomes.

- Upper age limit flexibility: Mortgage providers present adaptable upper age limits on applications, accommodating elder investors.

- Credit score significance: An excellent credit report augments your application, as lenders evaluate financial dependability through this.

- Property value and loan to value (LTV): The value of the property you desire to purchase and the loan amount you need have an impact on approval. Lenders monitor the LTV ratio rigorously.

- Rental income potential: Your aptitude to secure adequate rental income from the property is pivotal. It should cover mortgage repayments comfortably.

- Existing debts: Maintaining sensible levels of debt aids in demonstrating your financial stability to the mortgage lender.

- Stamp duty considerations: A First-time buyer are required to consider stamp duty land tax costs, which can influence their borrowing capacity.

- Legal responsibilities cognisance: Applicants are expected to comprehend the obligations that come with being a landlord, including the management of tenancy agreements and compliance with housing regulations.

- Professional advice: Consulting with mortgage brokers can provide perspectives into suitable mortgage products attuned to your situation and help understand lending criteria adequately.

These guidelines assist first-time landlords in preparing for the mandates they must fulfil when applying for a low deposit buy-to-let mortgage, simplifying the process of initiating property investment ventures.

Costs involved

After understanding the eligibility criteria for securing a buy to let mortgage, it’s crucial to delve into the costs involved. Securing a mortgage involves several fees and expenses that first-time landlords must account for.

- Property Valuation Fee: Lenders charge this fee to assess the value of the property you intend to buy. The cost varies depending on the property's size and value.

- Product Fee: This is charged by lenders for selecting their mortgage product. It can either be paid upfront or added to your mortgage amount, potentially increasing your interest payments over time.

- Conveyancing Fees: You’ll need a solicitor or conveyancer to manage the legal aspects of buying your property. They handle contracts, give legal advice, conduct local council searches, deal with the Land Registry, and transfer the funds to buy your home.

- Broker Fees: If you choose to use a broker like Commercial Trust, they will guide you through choosing a suitable mortgage deal. Their service comes at a cost, payable in two parts: a booking fee at application and the rest upon completion.

- Stamp Duty Land Tax: This tax applies when purchasing properties over a certain price in England and Northern Ireland. Rates vary based on whether you own additional properties.

- Mortgage Interest: Once you have secured your mortgage, you will need to pay interest on it monthly. Rates can vary greatly between fixed rate and variable rate mortgages.

- Insurance Costs: Protecting your new investment is essential; thus, building insurance is mandatory. You may also consider landlord insurance which covers damage to the property, liability claims from tenants, and loss of rental income.

- Maintenance and Repairs Fund: As a landlord, you are responsible for maintaining the property in good condition for tenants—setting aside money for repairs and routine maintenance helps avoid financial surprises later on.

Understanding these costs ensures that first-time landlords are financially prepared before stepping into their role as property owners.

Rules and regulations

Landlords must follow specific rules and regulations to avoid legal issues. One crucial regulation is ensuring properties are safe and fit for tenants. This involves conducting energy performance evaluations and maintaining standards to keep the property habitable. If landlords fail to comply, they may face fines or legal actions.

Furthermore, it's essential to note that some buy-to-let mortgages fall outside the Financial Conduct Authority's regulation scope. This means fewer protections if things go wrong.

Always check your mortgage agreement carefully and understand your responsibilities as a landlord, including meeting safety standards and managing financial obligations diligently.

Considering the location for the property

After understanding the rules and regulations related to securing a buy-to-let mortgage, it becomes critical to concentrate on selecting an optimal location for your rental property.

The area you choose significantly influences the outcome of your investment. Look for a location with high tenant demand. Consider cities or neighborhoods with universities, as these tend to draw in students constantly seeking housing.

Similarly, regions near business districts attract employees requiring residences.

Securing property in a region with excellent transport connections can markedly increase its appeal to prospective tenants. Individuals place importance on convenient access to work, schools, and facilities such as shops and parks.

Another factor to think about is future growth in the area, which could enhance property values and draw more tenants desiring quality living environments. Bear these considerations in mind during your search for the perfect location; it can distinguish a successful investment from a lacklustre one.

Challenges and Considerations

Stepping into the buy-to-let market comes with its own set of hurdles. First-time landlords must figure out how to ensure their rental earnings cover mortgage repayments and maintenance costs.

They also have to navigate tax laws, which include income tax on rental profits and capital gains tax when selling the property. Proper research and planning can help tackle these obstacles effectively.

Securing sufficient rental income

To secure enough rent from your property, you must make sure it meets the expectations of lenders. They look for the rental income to be at least 125% more than your monthly mortgage repayment.

This is called a stress test. It helps them see if you can cover your loan even if costs go up or you don't get rent for a while.

Choosing the right location and keeping the property in good condition play big roles in attracting tenants who pay well. You should also think about getting help from estate agents.

They can find reliable tenants quickly, which means less time without income for you. Setting a competitive but profitable rent will help ensure your investment pays off over time.

Managing tax implications

Landlords are required to pay tax on any profits made from rental income. After deductions such as allowable business expenses, including mortgage interest and maintenance costs, the remaining profit is taxable.

Those new to the buy-to-let sector must ensure that they understand this tax procedure. The tax rate is dependent on your total income for that year - this includes any salary earned from other employment in conjunction with your rental earnings.

Limited companies follow a separate set of rules, paying Corporation Tax at a fixed rate of 19%. If one is contemplating the adoption of a company structure for holding properties, it's crucial to consider all aspects as what may appear favourable tax-wise could bring in other challenges such as increased regulations or escalated lending rates for commercial mortgages.

Covering periods without rental income

To cover periods without rental income, first-time landlords need to plan carefully. One should always have a financial cushion. This means setting aside money each month into a savings account.

This fund acts as a safety net for times when the property isn't rented out. It’s wise for landlords to aim for at least three months' worth of mortgage payments in this emergency fund.

Landlords can also consider taking out insurance that covers loss of rent. This type of policy pays out if your buy-to-let property becomes uninhabitable or you can’t find tenants for a period.

Checking the terms carefully ensures that you understand what situations are covered and any exclusions. Lastly, regularly reviewing your budget helps manage costs efficiently, ensuring funds are available even when rental income stops temporarily.

How to Secure a Low Deposit Buy-to-Let Mortgage

Securing a low-deposit buy-to-let mortgage requires smart choices. Working with a financial expert can guide you through the process. Using tools like a mortgage calculator helps understand the different rates and costs involved.

Picking an experienced adviser ensures you make informed decisions on your investment journey.

Using a broker

Employing a broker can simplify the process of acquiring a buy-to-let mortgage for first-time buyers. Revolution Brokers can help you navigate your mortgage journey easily and effortlessly.

This broad variety of choices means you're more inclined to discover a mortgage meeting your requirements and budget.

Brokers also save you time by managing the paperwork and ensuring you have all the necessary documents ready. They provide financial advice adapted to your circumstances, which can expedite the approval process.

Their knowledge can make it easier to understand mortgage rates and decode the conditions. Subsequently, selecting an adviser is yet another vital action in securing your low-deposit buy-to-let mortgage.

FAQs

1. What is a buy-to-let mortgage for first-time landlords with low deposits?

A buy-to-let mortgage for first-time landlords with low deposit is a type of loan that allows first-time buyers, who wish to become landlords, to finance their buy-to-let property investment with a small initial payment.

2. How does the rate of interest affect my returns on investment?

The rate of interest can significantly impact your returns on investment from the rental income. A lower rate means less money paid back over time, increasing potential profits.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)