Capital Repayment Mortgage: Is It Right For You?

Do you need help understanding if a capital repayment mortgage is your right choice? These mortgages gradually reduce your debt through mandatory capital repayments while being easier to manage than interest-only options.

This article will explain everything you need to know, from benefits to comparisons with other types. Keep reading to take control of your mortgage decisions.

Understanding Capital Repayment Mortgages

A capital repayment mortgage requires paying the interest and part of the monthly loan principal. This method ensures your debt decreases steadily over time. To understand how a repayment mortgage work, it's essential to know that each payment reduces both the interest and the principal, ensuring the debt decreases steadily over time.

What is a capital repayment mortgage?

What is a repayment mortgage? It is a type of home loan where the borrower repays both the capital and interest in monthly installments over a specified term.

A capital repayment mortgage is a type of home loan. Here, you pay the interest and part of the original amount borrowed monthly. Over time, this reduces your total debt until it reaches zero by the end of the agreed term.

With each payment, you own more of your home. So, how does it work?

How repayment mortgages work

A repayment mortgage, or capital and interest mortgage, involves repaying the capital (the amount borrowed) and the interest each month. This type of mortgage ensures that your debt decreases over time, ultimately leading to full property ownership by the end of the mortgage term.

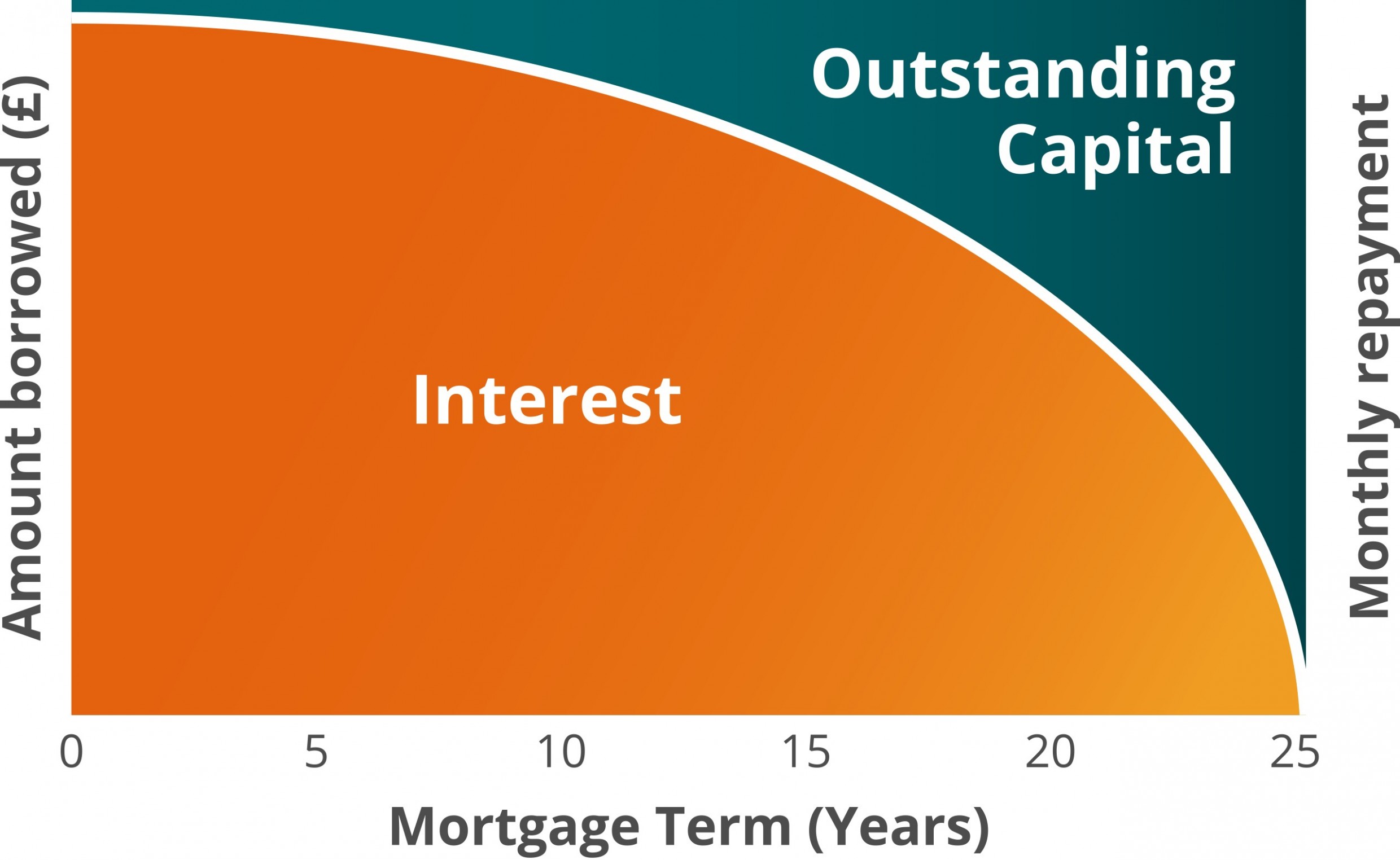

Each monthly payment is calculated based on the loan amount, interest rate, and mortgage term length. Initially, a larger portion of your payment goes towards paying off the interest, with a smaller portion reducing the capital. However, as you continue making payments, the interest portion decreases because it is calculated on the outstanding balance, which diminishes over time. Consequently, a larger portion of your payment goes towards repaying the capital.

Source: RouseLtd

By the end of the mortgage term, you will have paid off the entire loan amount, including both the capital and the interest. This gradual reduction in debt provides a clear path to owning your home outright, offering peace of mind and financial stability.

How does it differ from an interest-only mortgage?

A capital repayment mortgage means you pay both the interest and part of the loan principal each month. Over time, this reduces your debt until you own your property outright by the end of the term.

With an interest-only mortgage, you only pay the interest charged each month, while the loan principal remains unchanged unless paid off in one lump sum at the end.

Capital repayment mortgages offer a clear path to owning your home. They provide peace of mind as they have a predictable schedule. Interest-only mortgages might seem easier on monthly budgets but require careful planning for paying off large sums later.

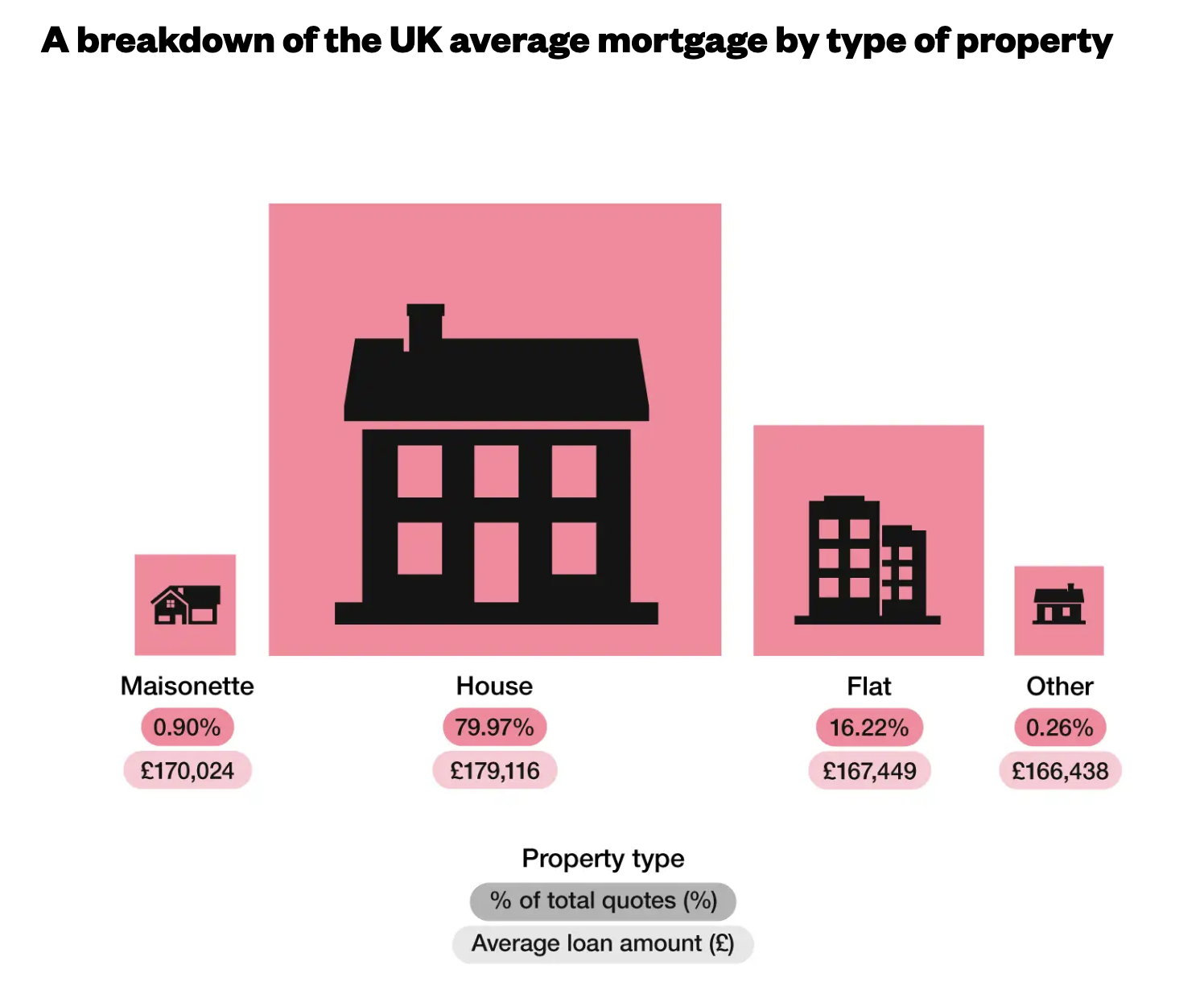

Source: Uswitch

Types of Mortgages

There are several types of mortgages available, each with its own characteristics and benefits. Understanding these options can help you choose the best mortgage for your financial situation and goals.

Repayment Mortgages

A repayment mortgage is a popular choice for many borrowers. With this type of mortgage, you repay both the capital and the interest each month. This ensures that your debt decreases over time, and you will have fully paid off the loan by the end of the mortgage term. Repayment mortgages are available with either fixed or variable interest rates, and the mortgage term can range from 10 to 30 years. This type of mortgage is suitable for most borrowers, as it provides a clear and predictable path to homeownership.

Interest-Only Mortgages

An interest-only mortgage allows you to pay just the interest on the loan each month, without repaying any of the capital. This results in lower monthly payments compared to a repayment mortgage. However, it’s important to note that you will still owe the original loan amount at the end of the mortgage term. Interest-only mortgages are often used by buy-to-let investors or those looking to keep their monthly payments low. If you choose this type of mortgage, you must have a plan in place to repay the capital, such as savings, investments, or selling the property.

Part-and-Part Mortgages

A part-and-part mortgage combines elements of both repayment and interest-only mortgages. With this type of mortgage, you pay off a portion of the capital and interest each month, while leaving a lump sum to be repaid at the end of the mortgage term. This offers flexibility, allowing you to tailor the mortgage to suit your individual needs. Part-and-part mortgages can be a good option if you want to benefit from lower monthly payments while still reducing some of the capital over time.

By understanding the different types of mortgages available, you can make an informed decision that aligns with your financial goals and circumstances. Whether you opt for a repayment mortgage, an interest-only mortgage, or a part-and-part mortgage, it’s essential to consider your long-term plans and ensure you have a strategy in place to manage your mortgage effectively.

Benefits of Choosing a Capital Repayment Mortgage

You will have a clear and predictable repayment timeline. Paying both interest and the loan principal reduces your mortgage debt over time.

Predictable repayment schedule

Capital repayment mortgages offer a predictable repayment schedule with monthly repayments that cover both the interest and part of the loan principal. This makes budgeting simpler since you always know your payment amount.

Having a fixed repayment plan also reduces stress over time. You see your debt decrease steadily until it’s gone by the end of the term. Knowing exactly how long you’ll be paying off the mortgage provides peace of mind.

Gradual reduction of loan principal

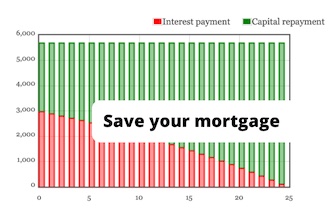

A predictable repayment schedule helps plan finances, and mortgage repayments gradually reduce the loan principal over time. However, a capital repayment mortgage also offers a gradual reduction of loan principal.

Each month, your monthly payments chip away at both the interest and the principal. Over time, this reduces what you owe. This means that by the end of your mortgage term, you’ll own your property outright.

You won’t need to find extra funds for a lump sum payment as with interest-only mortgages.

Source: Monevator

Should You Use Interest-Only or Capital Repayment Mortgages for Property Investments?

Interest-only and Capital Repayment Mortgages cater to different investment strategies and risk profiles. The table below summarises key differences to help you decide which option suits your property investment needs. It's also important to consider the criteria set by mortgage lenders when choosing between these options.

|

Criteria |

Interest-Only Mortgage |

Capital Repayment Mortgage |

|

Monthly Payments |

Lower, pay only interest |

Higher, pay interest and principal |

|

Principal Repayment |

Repay principal at the end of term |

Reduce principal gradually over the term |

|

Investment Flexibility |

Freer cash flow for other investments |

Less flexibility due to higher payments |

|

Risk |

Higher risk depends on property value at term end |

Lower risk, equity builds up over time |

|

Interest Costs |

Potentially higher over-term |

Potentially lower over-term |

|

Ideal For |

Experienced investors |

First-time buyers, risk-averse investors |

Should You Use Interest-Only or Capital Repayment Mortgages for Property Investments?

One of the most frequently asked questions when entering the world of property investment is whether to use interest-only mortgages or capital repayment mortgages. The consensus among seasoned investors is that interest-only mortgages are often the better choice, and here’s why. A mortgage repayment calculator can help you estimate your monthly payments and make an informed decision.

Increased Cash Flow

Interest-only mortgages offer a significant advantage when it comes to cash flow. Since you're only paying the interest on the loan, your monthly payments are lower than a capital repayment mortgage. This means you can keep more of your monthly rental income, increasing your overall cash flow—a crucial factor for any investor looking to scale their property portfolio.

Property Value Appreciation vs. Inflation

Another reason interest-only mortgage is a popular option among investors is the assumption that property values will continue to rise over time while the real value of the mortgage decreases due to inflation. Let’s look at a simple example:

- Suppose you purchase a property worth £100,000 using a 75% loan-to-value interest-only mortgage. This means you have a £75,000 mortgage.

- If property values double over the next ten years, which has been a common trend in the UK, your property could be worth £200,000.

- Even though the property's value has increased, your mortgage remains at £75,000. As a result, the mortgage now represents a much smaller percentage of the property's value.

- Fast forward another ten years, and if the property value rises to £400,000, the mortgage remains at £75,000. The gap between the property value and the mortgage continues to grow, increasing your equity and net worth.

The Impact of Inflation

Inflation, often seen as an opposing force, actually works in your favor when using interest-only mortgages. With inflation rates historically targeted around 2% by the Bank of England, the real value of the mortgage decreases over time. In today's money, a £75,000 mortgage might only be worth £50,000 in ten years or even less in twenty years due to inflation's effect. This continuous reduction in the mortgage's real value means you can hold onto your properties without paying down the capital while benefiting from increasing equity.

Final Thoughts

Interest-only mortgages allow property investors to maximize their cash flow, while capital repayment mortgages ensure regular mortgage repayments that reduce the debt over time. This strategy can be a powerful way to build a substantial property portfolio over time. If you want to learn more about building a profitable property portfolio, head to my website for a comprehensive workshop. You’ll discover the strategies that worked for me and the lessons I learned along the way so you can avoid the pitfalls and achieve success faster.

Conclusion

Choosing a capital repayment mortgage can be a wise decision. You gain a predictable payment schedule and reduce your loan over time. Consider your financial goals to decide if this option is right for you.

If you are unsure how to proceed, request a callback from our expert agents – and know that your financial future is in safe hands.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)