UK Inflation Vs. Rent Price Trends: Future Outlook Of The Housing Market

Since the pandemic, rent trends in the UK have reached record highs outside London. In this article, we’ll break down what’s happening, how you can navigate these changes, and how they impact rent trends and high inflation.

Current State of Rent and Inflation in the UK

Rent prices in the UK have surged since COVID-19. Rising inflation is also putting pressure on tenants and private landlords alike.

Trends in private rent since COVID-19

Private rent trends in the UK have shifted since the coronavirus disease emerged. The average rental property now gets 17 inquiries from tenants, down from 26 in early 2023 but still more than double the pre-pandemic level of eight in 2019.

Despite a 14% increase in overall rental supply compared to last year, availability remains 20% below its peak before the pandemic struck.

Tenant demand has also seen changes. There's a drop of 16% compared to last year, yet figures show a significant increase of 22% for tenants wanting to move since 2019. As of September 2024, available rental homes increased by 18%, which is still lower than pre-pandemic levels by about one-fourth.

Moreover, as of July, around 12.5% of homes for sale were previously rented properties. This shift reflects ongoing market adjustments after COVID-19 impacted housing needs and preferences across the UK.

Inflation rates are significantly affecting housing

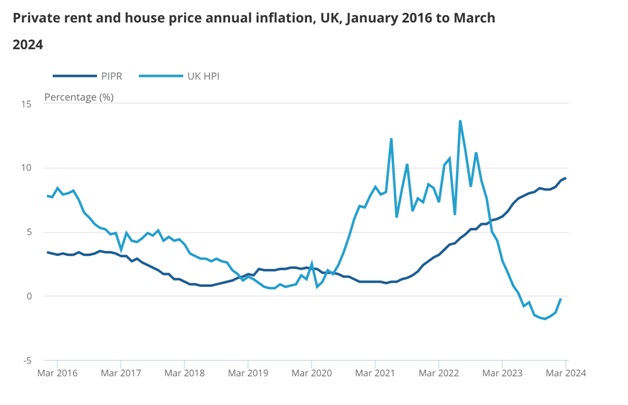

Inflation rates significantly impact housing. UK rental inflation dropped to 5.4%, the lowest in nearly three years. In 2023, inflation was at a high of 10.2%. The rate drop shows relief but still presents challenges in many countries outside the UK.

Rent increases are expected to be 3-4% throughout 2024. This is due to supply-demand imbalances that may last until 2025. Affordability constraints, which particularly affect low-income renters, limit how much rents can increase.

UK inflation rates by month over the past 12 months. (Source: TradingEconomics)

Impact of Inflation on Rent Prices

Inflation can push rent output prices higher. As consumer prices rise, landlords often increase rents to keep up with costs.

How inflation influences private rent adjustments

Inflation raises the cost of living, including housing. Private renters feel this through rising rent input prices. In 2023, rental inflation was close to half at 10.2%. This means that rents do not go up as quickly as before but still rise.

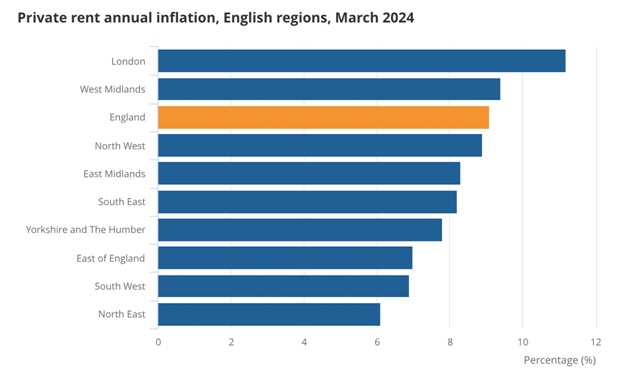

Non-city areas see higher rental price hikes, between 6.8% and 7.4% each year. Major cities like London had a peak annual growth of 16% in pre-COVID times but have slowed significantly.

Inflation directly affects tenants who must spend more on their monthly rent, while wages may not keep pace with these increases.

Predictions for future rent increases

Rent hikes will continue into 2024, with projections indicating a 3-4% rise by the year's end. The persistent supply-demand imbalance in the rental market drives these increases.

Landlords may face increased pressure to sell properties due to potential tax changes expected in autumn 2024 after the national lockdown and public health concerns.

This expected trend suggests a tough time ahead for renters. Experts anticipate that rental inflation will likely fall between 3% and 4%. This small reprieve does not fully address lower incomes and housing shortages.

UK rents inflation is rising to record-highs. (Source: ONS)

Future Outlook for the UK Housing Market

The UK housing market will likely face continued rent increases. Policymakers might help ease prices for renters.

Expected trends in rent and house prices

Expect rent and house prices in the UK to shift throughout 2024. Here are the expected trends:

- Rent Increases: Due to inflation after COVID, rent increases will likely be around 3-4% in 2024. This marks a slowdown compared to previous years.

- House Prices: House prices might not see large jumps next year. Factors like consumer price inflation and global economy uncertainty play roles.

- Regional Differences: London should experience slower rental inflation than Northern Ireland, Scotland, and Wales. Major cities are less affected than smaller regions.

- Tenancy Lengths: The average length of a tenancy ranges from 30 to over 40 months. Longer tenancies and timely notice periods help stabilise rent increases for renters.

- Government Interventions: Potential government measures could slow rent hikes further if implemented effectively.

- Supply and Demand: Limited supply will still keep some pressure on prices. However, adjustments in demand may balance the market slightly.

- Economic Factors: Wage growth and employment statistics will also impact how much people can afford to pay in rent or mortgages.

- Social Housing Changes: Shifts in social housing policies might relieve some pressure on private rents but will only solve some issues.

- Labour Market Influence: Job market conditions affect people's ability to pay higher rents or buy homes, adding another layer of complexity.

- Cost of Living Crisis: The ongoing cost of living crisis means more households might find renting challenging, potentially increasing demand for social housing.

These factors indicate a cautious outlook for renters and buyers in the UK housing market.

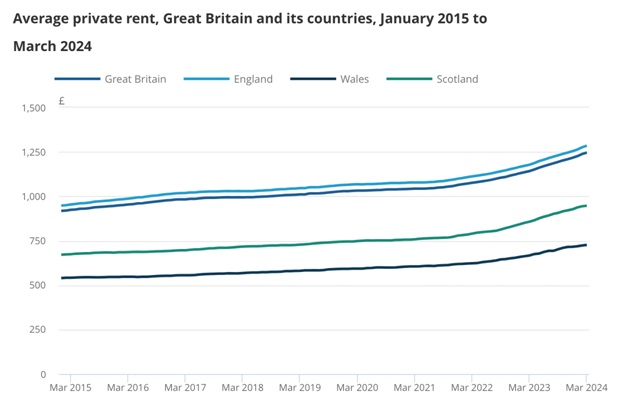

The average rent price in Great Britain was north of £1,200 in March 2024. (Source: ONS)

Potential government interventions and their effects

The UK government has many tools to manage rent and housing prices. These interventions can impact both renters and landlords in various ways.

- Tax Reform Possibility: Speculation about tax changes may push landlords to sell properties in the autumn of 2024. This could lead to fewer rental units.

- Rent Controls: Capping rent increases might protect low-income renters. However, it may also discourage new investments in rental properties.

- Social Security Adjustments: Changing the Local Housing Allowance can help renters cover costs. Yet, this may not be enough if the market rents rise too much.

- Eviction Laws: Protecting tenants' rights against no-fault evictions can offer more stability for renters. On the downside, some landlords might exit the market.

- Government-Sponsored Training: Resources like Rightmove Hub offer training courses for letting agents and landlords, leading to a better-managed rental sector.

- Published Reports: The Zoopla Rental Market Report provides new data for stakeholders, helping them make informed decisions.

These potential actions provide an overview of what might affect the UK's housing market in the future.

The average rent price inflation was highest in London, followed by West Midlands and England as a whole. (Source: ONS)

Will rent prices keep rising?

Inflation and rent trends in the UK remain complex. Rent prices will likely keep rising, especially outside big cities. Landlords need support to invest in quality homes, and government actions may influence future trends.

Renters can expect ongoing challenges but also potential changes for better living conditions.

For the extra curious

1. How has the rent market in the UK changed post-COVID?

The rent market in the UK saw significant shifts after COVID. Rent rates have fluctuated and been influenced by changes in supply and demand and economic factors.

2. What are the current trends for private rented sector rents in the UK?

Current trends show varying growth rates across regions. Official statistics from HM Land Registry and price indices like those from The Royal Institution of Chartered Surveyors provide detailed insights into these patterns.

3. How does inflation impact rental income and house prices in a post-COVID world?

Inflation affects rental income and house prices, leading to adjustments in rent rates across different areas. This is reflected in data such as the House Price Index provided by HMLR.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)