What Do Higher Mortgage Rates Mean For The Housing Market In 2024?

Are you feeling the pinch with climbing mortgage rates? The Bank Rate has stuck at 5.25% since August 2023, impacting everyone looking to buy a home. This post will explore what higher mortgage rates mean for the housing market mortgage rates in 2024, from affordability shifts to changing UK house prices.

Get ready for insights that could help navigate these waters.

Exploring Mortgage Rates

Exploring mortgage rates reveals how they get shaped by various factors. Key trends highlight their impact on the housing market.

What shapes mortgage rates

Several factors influence mortgage rates, and understanding these can help borrowers navigate the impact on the housing market. Central banks, such as the Bank of England, play a crucial role by setting benchmark interest rates that affect what consumers pay for mortgages.

For instance, the Bank Rate was held at 5.25% following a 7-2 vote. This decision directly influences lenders' pricing for new mortgage loans and the interest existing borrowers pay.

Economic indicators also significantly shape mortgage rates; inflation is a primary example. When inflation rises, it often leads to higher mortgage rates because lenders need to ensure their returns remain valuable over time.

In recent trends, we've seen CPI drop from an alarming 11.1% in October 2022 to a more manageable 3.2% in 2024, suggesting potential shifts in mortgage rate trends ahead and impacting housing market dynamics like affordability and home prices.

Key trends in mortgage rates

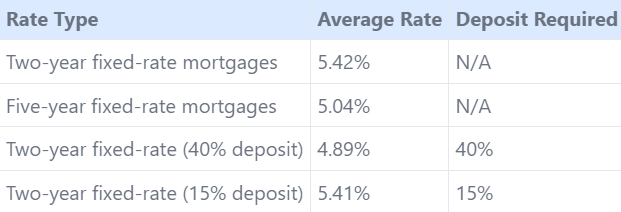

Key trends in mortgage rates have been notably fluctuating, impacting potential homebuyers and investors across the housing market. The data presented below outlines the recent movements and tendencies within the mortgage rate landscape, providing valuable insights into the financial dynamics at play.

These figures indicate a rise in the average house prices and rates for two-year fixed-rate mortgages, now sitting at 5.42%. Meanwhile, five-year fixed-rate mortgages have stabilized at 5.04%. The variability in rates based on the deposit amount highlights the significant impact of upfront financial commitments on mortgage costs, with a 40% deposit securing a more favorable rate of 4.89% compared to 5.41% for those with a 15% deposit.

Transitioning into the effects of rising mortgage rates on the housing market, it's essential to consider how these trends influence buyer affordability, home prices, and overall market risks.

Effect of Rising Mortgage Rates on the Housing Market

Rising mortgage rates often make buying a home more expensive for borrowers. This can slow down the pace of people purchasing homes, impacting the overall housing market.

How affordability changes for borrowers

Affordability takes a significant hit for borrowers as higher mortgage rates make their mark on the housing market. For those holding variable or tracker mortgages, changes in rates won't immediately affect their payments.

Yet, individuals with fixed-rate mortgages face a steep climb once their current deals conclude, confronting them with notably higher rates they must manage. This shift strains many homeowners' budgets more tightly than before.

The tangible impact of these climbing mortgage rates is evident in the burgeoning annual mortgage repayments that the average house price buyer now shoulders—a significant 61% increase over just three years.

Astonishingly, two-thirds of this surge stems directly from the uptick in mortgage rates themselves, revealing how critical these figures are in determining overall affordability within the UK housing market.

Two-thirds of the rise in repayments is due to higher mortgage rates.

Influence on home prices

As affordability changes for borrowers, this directly influences home prices in the housing market. Higher mortgage rates can cool down a hot market by making homes less affordable to many buyers.

This shift often leads to a decrease in demand, which can stabilize or even lower home prices in some regions. Yet, recent data shows a complex picture: despite rising mortgage rates impacting the housing market, different areas experience varied effects on home prices.

For instance, Halifax reported an interesting trend where the average UK house price saw a 1.1% annual increase in April 2024, reaching £288,949. This growth wasn't uniform across all regions; Northern Ireland experienced the largest jump with house prices rising by 3.4% year-on-year, closely followed by a 3.3% rise in the North West of England.

On the other side of the spectrum, southern England witnessed mainly price falls. These trends underscore how factors like location and regional economic health intertwine with mortgage rates to shape the housing market landscape differently across various areas.

Risks to the housing market

Rising mortgage rates affect the housing market in several ways. High mortgage rates can slow down the number of people buying homes because loans become more expensive to repay. This situation makes it tough for first-time buyers and those looking to remortgage, as pointed out by Amanda Bryden of Halifax.

With increased borrowing costs, families might find it harder to afford homes, leading to fewer sales and potentially causing house prices to stagnate or even fall in some areas. Sarah Coles from Hargreaves Lansdown highlights how a "wonky" market with regional price disparities adds another layer of complexity, making some regions feel the pinch more than others.

These conditions could lead to a less vibrant housing market as potential buyers wait on the sidelines for better conditions or lower prices. The impact of higher mortgage rates on the housing market could also mean sellers may have to adjust their expectations if demand weakens due to affordability issues caused by higher interest rates.

As we move forward, exploring predictions for mortgage rates in 2024 becomes crucial for understanding future trends in home buying and selling.

Predictions for Mortgage Rates in 2024

Experts predict mortgage rates could rise in 2024. Economic factors will play a big role in these shifts.

Expert forecasts

Predicting the future of average mortgage rates and their impact on the housing market is a complex task. Experts use a variety of economic indicators and trends to make their forecasts for 2024.

- Savills has projected a moderate growth in house prices, forecasting a 2.5% increase in 2024. This reflects cautious optimism in the face of higher mortgage rates.

- Looking further ahead, Savills also anticipates a more substantial rise, expecting property prices to climb by over 20% by 2028 despite current concerns over inflation affecting both the housing market and mortgage market rates.

- Halifax looks at potential interest rate cuts as a key factor that could drive the average house prices to rise modestly in 2024. Such cuts would ease borrowing costs, slightly offsetting the pressure from higher than typical mortgage term rates.

- Economists surveying the broader financial landscape expect base rates to decrease to 3.5% by the end of 2025. This anticipated decline suggests that while mortgage rates may remain high into 2024, there's potential for relief on the horizon for borrowers.

- The consensus among experts indicates that while inflation continues to challenge both buyers and sellers by pushing up mortgage rates and housing prices, strategic adjustments in monetary policy could provide some stabilization in the housing market index as it relates to mortgage rates.

Economic factors that could shift rates

Interest rates have a direct impact on mortgage rates and the housing market. The Consumer Price Index (CPI) plays a crucial role in this relationship. With the CPI dropping from 11.1% in October 2022 to 3.2% in 2024, it signals changes that could influence interest rate decisions by financial institutions.

These changes are vital for both borrowers and investors to monitor as they can lead to shifts in mortgage rates.

The Bank Rate, set at 5.25% to control inflation, is another significant factor affecting mortgage rates and, consequently, the housing market index mortgage rates. If inflation moves towards the target CPI of 2%, there may be room for lower interest rates, resulting in modest declines in mortgage rates.

This movement would directly affect affordability for borrowers and could either cool down or heat up the housing market depending on how these economic factors play out over time.

Decisions faced by borrowers

As economic factors play a significant role in shifting rates, borrowers need to make informed decisions regarding their mortgages. Those with variable or tracker mortgages will be relieved to know that their rates remain unchanged despite fluctuations in the housing market.

On the other hand, individuals with a year fixed-rate mortgage must prepare for possible higher rates once their current deals expire. This situation demands careful consideration of one's financial strategy moving forward.

Borrowers have several strategies at their disposal to cope with changes in mortgage rates and the overall impact on the housing market. Making overpayments where possible can reduce total interest costs and shorten the mortgage term, offering long-term savings.

Extending the mortgage term might also be a viable option for those seeking lower monthly payments, although this could mean paying more interest over time. Exploring joint mortgages is another avenue, providing access to potentially lower rates due to reduced risk for lenders.

These decisions are crucial as they directly influence an individual’s ability to navigate through a period marked by rising mortgage rates and inflation affecting the housing market.

Strategies for Managing Higher Mortgage Rates

Discover ways to handle higher mortgage rates with smart strategies that can make borrowing more manageable so that the borrowing costs remain low.

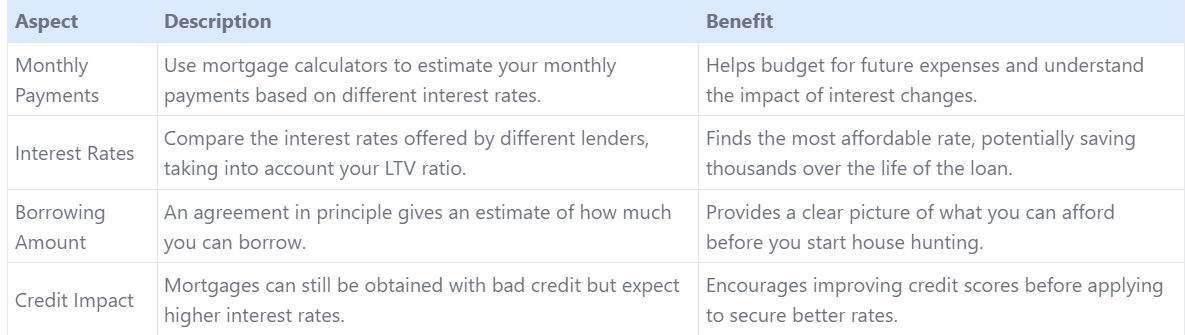

Comparing mortgage offers

Comparing mortgage offers is crucial for managing higher mortgage rates effectively. The table below simplifies this process by highlighting key aspects to consider.

This comparison highlights the importance of understanding the various elements that influence mortgage offers. By focusing on these aspects, borrowers can more effectively handle the process of obtaining a mortgage with a higher interest rate, ensuring they make informed decisions that suit their financial situation.

Tips for affordable mortgage options

Navigating the housing market with higher mortgage rates can be a challenge. Yet, several strategies can help borrowers find more affordable mortgage options.

- Compare various mortgage offers to secure the best interest rate and terms that suit your financial situation.

- Consider making overpayments on your mortgage when possible, as this can reduce the total interest paid over time.

- Look into extending the term of your mortgage to lower monthly payments, making it easier to manage financially.

- Explore an interest-only mortgage for lower monthly costs, keeping in mind that you will need to repay the loan amount eventually.

- Apply for a joint mortgage with someone else, which might offer lower rates due to reduced risk for lenders.

- Investigate government programs intended to assist with obtaining a mortgage under more favorable conditions.

- Pay close attention to all mortgage fees, including arrangement, booking, valuation, and conveyancing fees, to avoid surprise costs.

Each of these tips offers a pathway to managing the impact of higher mortgage rates on affordability within the housing market.

Government programs for assistance

Handling higher mortgage rates in the housing market can be challenging. Fortunately, several government programs offer assistance to prospective homebuyers.

- The 95% Mortgage Guarantee Scheme helps buyers secure a mortgage with just a 5% deposit, making it easier to get into the housing market.

- Shared Ownership allows purchasers to buy a share of their home (between 25% and 75%) and pay rent on the remaining share, reducing initial costs.

- Help to Buy offers equity loans to first-time buyers and home movers on new-build homes, where you need only a 5% deposit.

- The First Homes Scheme is designed for local first-time buyers, offering homes at a discount of at least 30% compared to the market price.

- Forces Help to Buy provides an interest-free loan up to 50% of salary, capped at £25,000, for servicemen and women to buy their first home or move to another property.

- Right to Buy enables most council tenants to buy their council home at a discount, significantly lowering the barrier for homeownership.

- Lifetime ISA gives anyone aged 18-39 the chance to save tax-free with a government bonus of 25%, up to £1,000 per year, towards their first home or retirement savings.

Each program aims to make it more accessible for individuals and families to handle the often expensive journey of buying a home amidst rising mortgage rates in the housing market.

Conclusion

Higher mortgage rates in 2024 challenge both buyers and sellers in the housing market. Buyers face higher costs, making affordability a key concern. Sellers may need to adjust expectations as fewer people can afford high prices.

Yet, with potential rate cuts on the horizon, there's hope for relief. The housing market remains resilient, adapting to changes and finding new balances between supply and demand. If you contact our team at Revolution Brokers, you can find out information about the current uk mortgage rates, top choices for a mortgage with adequate loan to value rates and expert opinion from a mortgage lender.

FAQs

1. What happens to the housing market when mortgage rates go up in 2024?

When mortgage rates rise, buying a house becomes more expensive. This can slow down how many people are buying homes, impacting the housing market by possibly lowering demand.

2. How do higher mortgage rates affect housing prices in 2024?

Higher mortgage rates can lead to increased costs for borrowing money, which might push up housing prices as sellers try to cover these higher costs or adjust for lower demand.

3. Can inflation affect the housing market and mortgage rates in 2024?

Yes, inflation is hitting the housing market by making everything more expensive, including homes. This often leads to higher mortgage rates as lenders increase rates to keep up with inflation.

4. Why are mortgage rates important for deciding whether to buy a house in 2024?

Mortgage rates determine your monthly payments on a home loan; when they're high, your payments will be higher too. Knowing about future trends helps you decide if it's a good time to buy or wait for lower rates.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)