The Impact of Mortgage Rates Rising on Homeowners and the Housing Market

Are you feeling the pinch as mortgage rates climb? Recently, those rates hit a 15-year peak at 5.25%. This post will guide you through managing these hikes and their effects on both homeowners and the property market.

Stay with us to find smart moves in this shifting landscape.

Key Takeaways

- Mortgage rates reaching a 15-year high at 5.25% forces homeowners to rethink their finances and future plans, making it harder for them to manage expenses.

- High mortgage rates impact the housing market by driving down property values as buyers can afford less, leading sellers to lower prices in a slower market.

- Around 900,000 borrowers could face larger monthly payments on their home loans, which pushes many to adjust how they spend and save.

- First-time home buyers find it challenging due to stricter affordability checks required by lenders because of rising mortgage rates.

- Various strategies like looking for new mortgage deals early, improving credit scores, and considering different loan terms can help homeowners secure lower interest rates.

Factors Influencing Mortgage Rates

Central banks like the Bank of England play a massive role in setting mortgage rates. They set the bank rate, which is the interest rate that banks pay to borrow money. For example, when the Bank of England raised its bank rate to 5.25% in August, it signaled to lenders across the country to adjust their own rates.

This is because as banks face higher costs to borrow money, they pass these costs on to consumers through higher mortgage interest rates.

Inflation also influences mortgage rates significantly. High inflation can lead lenders to raise interest rates on loans including mortgages. This compensates for the decreased purchasing power of money over time.

When inflation rose to 4% in December, concerns grew about sustained high-interest rates aiming at controlling inflation and maintaining financial stability in markets.

Interest rates are essential tools for central banks in managing economic growth and keeping inflation under control.

Predictions for Mortgage Rates in 2024

Experts from major banks forecast mortgage rates might climb higher in 2024. This change could make homes less affordable for many people.

Major Financial Institutions and Their Predictions

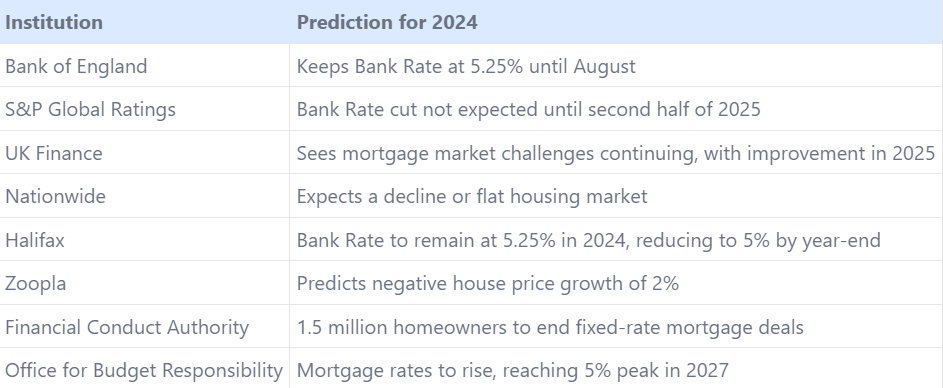

Major financial institutions have shared their predictions on mortgage rates and the housing market. Here's a concise summary presented:

This table shows what major institutions forecast for the next few years. Their views help us understand likely changes in the mortgage rates and housing market.

Impact on House Prices

As mortgage rates rise, home values feel the pressure. Higher borrowing costs mean buyers can't afford as much, which drives down property values. Sellers might lower prices to attract interest in a slower market.

This shift impacts homeowners looking to sell or leverage their home's equity.

Mortgage lenders watch these trends closely because they affect lending risk and demand for new mortgages. The ripple effect touches not just individual families but the entire economy, linking house prices with financial stability and consumer spending power.

The Effect of Rising Mortgage Rates on Homeowners

Rising mortgage rates force homeowners to rethink their finances and future plans. They often have to work with mortgage advisors and use mortgage calculators to adjust their budgets and make tough choices about spending and saving.

Challenges in Remortgaging

Securing a new mortgage deal can be tough for homeowners due to the current 15-year high in mortgage rates. This situation means monthly payments may shoot up, making it harder for homeowners to manage their finances.

Those who wish to switch from their lender's standard variable rate (SVR) to more favorable fixed-rate mortgage deals agreement might find fewer options available. High rates can also scare off people looking into refinancing their home loans.

Another hurdle is the decrease in external remortgaging by 21% since last year, showing that fewer owners are able to find better deals outside of their current providers. This drop points towards tightening lending criteria and possibly higher fees associated with securing a new mortgage or transferring products.

Such challenges can lead to owners being stuck on high SVRs, increasing the cost of living at a time when managing expenses is already tough for many families.

Strategies to Get Lower Mortgage Rates

Getting a lower mortgage rate can save homeowners thousands of dollars over the life of their loan. It requires a good strategy and some informed decisions. Here are ways to achieve that:

- Start your search early for a new mortgage deal. Doing this allows you more time to compare rates from different lenders and find the best offer.

- Use a fee - free mortgage advisor for help. They can guide you through the process, compare deals, and find ones with competitive rates without charging extra fees.

- Boost your credit score before applying for a mortgage. Lenders use your credit history to decide your interest rate. A higher score can lead to lower rates.

- Save for a larger down payment on your home purchase. Putting more money down up front often secures lower interest rates since it reduces the lender's risk.

- Consider different loan terms by talking to your current lender or exploring options with others. Sometimes, changing the length of your loan can get you a better rate.

- Lock in a rate up to six months before your current mortgage ends if possible. This strategy can protect you from potentially higher rates in the future.

- Check if you qualify for any government programs like support for mortgage interest or lifetime ISAs which can indirectly affect your overall borrowing cost positively.

- Manage other debts wisely - pay off high-interest unsecured debts like credit cards first, which improves your debt-to-income ratio and makes you more attractive to lenders.

Each of these strategies offers an opportunity to reduce the amount paid over time by securing a lower interest rate from the start or during remortgage negotiations.

The Impact on Budget and Future Plans

Rising mortgage rates mean homeowners must adjust their budgets and future money plans. Around 900,000 borrowers could see their monthly mortgage payments rise. This forces many to rethink how they spend and save.

Homeowners might also look into extending their loan terms or finding ways to cut costs elsewhere. Planning for higher payments when remortgaging in 2024 is smart. Making informed choices now can prevent financial strain later.

The Effect of Rising Mortgage Rates on the Housing Market

Rising mortgage rates shake up the housing mortgage market, making homeowners think twice before selling and pushing buyers to act fast.

Fluctuating Mortgage Rates and Their Impact

Mortgage rates have been like a roller coaster in the UK, going up and down. Some banks raised their rates for fixed-rate home loans in March 2024. This means people who borrowed money to buy homes found themselves facing higher costs.

The Bank of England kept its key lending rate at 5.25% during the same period, stirring talks of a possible decrease come June.

These changes affect homeowners mortgage holders and the housing market in big ways. Around 1.5 million of the existing customers will see their mortgage deals end in 2024, pushing them into higher monthly repayments unless they find better deals quickly.

Also, with around 5 million households expected to pay more on their mortgages between now and 2026, many could struggle to keep up with these rising costs, affecting their budgeting and future financial plans significantly.

Predictions for the Next Five Years

Experts suggest mortgage rates might start to stabilize, leading to a more predictable market for homeowners and buyers. This comes after periods of volatility that have made managing loans challenging for many, especially with all prices like energy and food prices rising worldwide.

As rates find their footing, individuals could find it easier to plan their finances without fearing sudden increases in repayments.

Looking ahead, the housing market may see gradual changes rather than extreme shifts. Predictions indicate a movement towards recovery, with house prices possibly stabilizing or witnessing modest growth as the market adjusts to new economic conditions.

This shift could open opportunities for first-time purchasers and those looking to refinance, making the dream of owning a home more attainable for many.

Impact on First-Time Home Buyers

Rising mortgage rates challenge first-time home buyers by changing how much they can borrow and the types of homes they can afford.

Understanding Borrowing Capacity

Knowing how much money you can borrow for a house is critical, especially with mortgage rates on the rise. Lenders look at your income and debts to decide this amount. They use tools like affordability checks to make sure you can handle higher payments without struggling.

With mortgage costs increasing, these checks have become stricter.

First-time buyers face a tough situation because of these changes. The Bank of England has shared that rising mortgage rates mean people need to pass tougher tests to get loans for homes.

This ensures borrowers won't fall into negative equity or struggle with payments if rates go up further.

Choosing between these different mortgages depends on your financial situation, risk tolerance, and long-term goals. With 900,000 borrowers facing potential increases in their monthly mortgage payments by over $500, understanding these options is more important than ever for homeowners and first-time buyers looking towards 2024 when many will see their fixed-rate deals end. This looming deadline makes it essential to carefully consider which mortgage type aligns best with your needs and future plans amidst changing housing market conditions and mortgage rate predictions by major financial institutions.

True Cost of Buying a Home

Exploring the ups and downs of different mortgage types leads us to an important aspect: understanding the true cost of home ownership. This includes more than just the sale price or the interest rate on a loan.

Home buyers must also factor in stamp duty, valuation fees, and lawyer charges. These extra costs can add up quickly, making the initial budget for buying a house skyrocket.

Beyond these upfront expenses, ongoing costs such as property upkeep, insurance premiums, and possibly higher interest payments if rates climb affect homeowners' finances over time.

For first-time buyers figuring out their borrowing capacity against rising mortgage rates can be tough. Their monthly payments might increase significantly over the years, especially with fixed deals ending and variable rates adjusting upwards due to economic shifts like inflation or policy changes by financial authorities.

Conclusion

Rising mortgage rates shake homeowners and the housing market. Homeowners face higher payments, pushing some to find better deals. The housing market feels the pinch too, with fluctuating house prices and cautious buyers.

First-time home buyers must navigate these waters carefully, weighing their options in light of high rates. For everyone involved, understanding mortgage trends becomes crucial to making smart decisions.

FAQs

1. Why are mortgage rates rising?

Mortgage rates are rising because of changes in monetary policy, inflation rate increases, and financial market adjustments.

2. How do rising mortgage rates affect homeowners?

When mortgage rates go up, homeowners with variable rate mortgages or those looking to refinance might see their monthly payments increase.

3. Will mortgage rates keep rising?

Economists predict that if inflation continues and the economy faces challenges like a recession, mortgage rates may keep going up.

4. What can I do if my mortgage payment goes up?

If your payment increases, consider talking to a mortgage broker for advice on refinancing or switching to a fixed-rate mortgage for more stable payments.

5. Are there any benefits to the housing market when interest rates rise?

While higher interest rates can slow down buying activity, they can also help control runaway inflation and stabilize financial markets over time.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)