Why Investing In Property Long-Term Has Never Failed

Have you ever wondered if there's a surefire way to grow your money? Investing in property long-term has been a go-to strategy for many savvy investors. In the UK, property values have doubled every 8-10 years on average since the 1950s.

This blog will show why investing in bricks and mortar is smart. Are you ready to unlock the secrets of property investing?

Key Takeaways

- UK property values have doubled on average every 8-10 years since the 1950s, showing consistent long-term growth.

- Buy-to-let investments offer steady rental income and potential capital appreciation, with options available even for those with bad credit.

- Off-plan property investments can offer lower entry prices and value increases during construction, but they also come with risks like project delays.

- Property investments act as an inflation hedge, with values and rental income typically rising faster than general price levels.

- Diversifying across different property types and locations helps balance risk and reward in a long-term investment strategy.

What Are The Best Long-Term Property Investment Types?

Long-term property investment isn't just a flash in the pan. It's about playing the long game with your eyes on the prize years down the road.

Buy-to-Let (BTL) Options

Buy-to-let is a popular long-term property investment strategy in the UK. It involves purchasing a property to rent out to tenants, providing a steady income stream and potential capital growth.

Revolution Finance Brokers Ltd offers Buy-to-Let mortgages for property investors, including options for those with bad credit. This approach allows investors to build a property portfolio while benefiting from rental income and property value appreciation.

Many UK properties are purchased by investors looking to profit from the rental market. Buy-to-let mortgages from Revolution Finance Brokers address various financing needs, making it easier for investors to enter the market.

These loans are created specifically for property investment, helping clients find affordable financing solutions quickly and accurately.

Off-Plan Property Investment

Moving from Buy-to-Let, let's explore another exciting option in property investment. Off-plan property Investment offers a unique chance to buy homes before they're built. This strategy can lead to big wins for smart investors.

Buying off-plan means you put down money on a property still in the planning stage. The main draw? You often get a lower price than you would for a finished home. Plus, as the building goes up, so might the value of your investment.

But it's not all smooth sailing. Off-plan investments come with risks. The project might face delays or even fail to finish. That's why it's vital to do homework on the developer and the area before jumping in.

Residential Buy-to-Let

Off-plan property investment paves the way for another popular option: residential buy-to-let. This strategy lets investors buy homes to rent out for profit. It's a hit with many UK property buyers looking for steady income.

Revolution Finance Brokers Ltd knows this well. They help folks get buy-to-let mortgages quickly and at reasonable rates. Whether you are self-employed or work somewhere, these offer a great option because they work for different types of properties. You might fancy a flat in the city or a house in the suburbs. The key is finding tenants who'll pay rent month after month.

Some investors even snap up homes that need work. They fix them up and charge higher rent. It's not always easy, though. You've got to think about things like repairs and problem tenants.

But with the right approach, it can pay off big time.

Types of homes UK residents live in (Image source: Mortgage Finance Gazzette)

Long-Term Property Investment Benefits

Long-term property investment offers a goldmine of benefits. It's like planting a money tree that keeps giving year after year.

Steady Income Stream

Property investment offers a reliable way to earn money regularly. Landlords can count on monthly rent payments from tenants, creating a steady cash flow. This income stream helps cover mortgage costs, property taxes, and maintenance expenses.

It also provides extra money for investors to save or spend as they wish. Buy-to-let mortgages make it easier for people to start earning from property investments.

Over time, property values tend to rise, boosting the potential income from investments. This growth allows landlords to increase rents, leading to higher returns. As a result, long-term property investments often yield stable financial gains.

By spreading investments across different properties, investors can further secure their income and reduce risks tied to market changes.

Capital Appreciation

Capital appreciation stands as a cornerstone of long-term property investment. Property values tend to rise as time passes, boosting the investor's wealth. This growth often outpaces inflation, making real estate a solid choice for building wealth.

The UK property market has shown steady growth over decades, with some areas seeing dramatic increases. It is one of the best ways to makethe most of your asset finance and working capital.

Investors holding properties for extended periods typically reap the most significant rewards. They can ride out short-term market dips and benefit from long-term trends. Savvy investors look for areas with growth potential, such as up-and-coming neighbourhoods or cities with improving infrastructure.

The following key benefit is the steady income stream that long-term property investments can provide.

Inflation Hedging

Property investments offer a solid shield in an unstable economy with inflation. As prices rise, so do property values and rental income. This means your money keeps its buying power over time. History shows that long-term property investments have never failed to beat inflation.

They grow faster than the general price level, keeping your wealth safe from the eroding effects of rising costs.

Real estate is a top choice for those looking to protect their savings. Unlike cash in the bank, which loses value when inflation hits, property tends to gain worth. Rents often go up with inflation, boosting income.

Plus, as building costs increase, existing properties become more valuable. This makes long-term property investment an intelligent way to keep your money working for you, even when prices rise.

(Image source: Pexels)

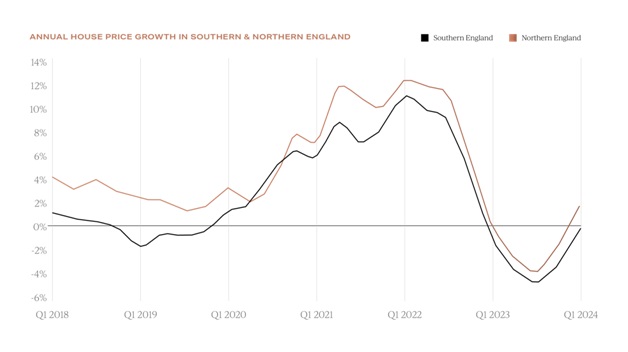

Historical Performance and Resilience

Property investments have stood the test of time. The UK property market has grown steadily over the years. Data reveals a consistent upward trend in house prices, with occasional dips followed by strong recoveries. This pattern has made the property a reliable long-term investment option.

Experts point to several factors driving this growth, including the increase in the population, the limited housing supply, and government policies supporting homeownership. They say that “property investment is like planting a tree – the best time to start was 20 years ago; the second-best time is now.”

Historical data backs up the claim that property values rise over time. For instance, the average UK house price has tripled since 1995. Even during economic downturns, the market has proven resilient.

Property prices bounced back faster after the 2008 financial crisis than other investment types. This consistent growth makes long-term property investments in the UK an attractive option for many investors.

Recovery and Stability in Economic Downturns

Property investments shine during tough times. When the economy hits a rough patch, they bounce back faster than other assets. At Revolution Finance Brokers, we offer smart solutions to help you weather financial storms.

Their range of options, like bad credit mortgages and buy-to-let deals, keep investors afloat.

Quick action is key in a downturn. That's where bridging loans come in handy. They provide fast cash to grab opportunities or fix urgent issues. This speed helps investors stay strong even when markets wobble.

With these tools, long-term property investments in the UK stand firm against economic shocks. They offer a steady ship in choppy waters.

Check our bridging loan calculator to identify your estimated monthly costs, interest, and maximum borrowing values when getting a loan of this type.

(Image source: Garrington)

Strategies for Successful Long-Term Property Investment

Want to make a killing in property? Let's chat about some clever tricks to boost your long-term investment game. Fancy learning more?

-

Research Your Potential Markets

Researching potential markets is key to smart property investing. You need to look at areas with growing populations and job markets. These spots often see house prices go up over time.

It's also smart to check out local plans for new roads, shops, or schools. Such changes can make an area more popular and boost property values.

Don't just focus on big cities. Sometimes, smaller towns or up-and-coming areas offer better deals. Look at rental demand, too. A high need for rentals means you're more likely to find tenants easily.

Keep an eye on crime rates and school ratings as well. These factors play a big role in an area's appeal. Next, let's talk about how to pick the right property once you've found a promising market.

(Image source: Garrington)

-

Choose the Right Property

Picking the right property is key to long-term success in property investment. Location matters a lot. Look for areas with good schools, transport links, and job prospects. These factors often lead to steady demand and value growth.

Also, think about the type of tenants you want to attract. Young professionals might prefer city flats, while families may seek houses with gardens.

Don't forget to check the property's condition. A well-maintained home can save you money on repairs down the line. It's smart to get a survey done before buying. This can spot any hidden issues that could cost you later.

Lastly, crunch the numbers. Make sure the potential rental income covers your costs and leaves room for profit. With careful choice, your property can become a valuable asset over time.

-

Diversify Your Investment Portfolio

Spreading your money across different types of properties can boost your chances of success. Smart investors don't put all their eggs in one basket. They mix it up with flats, houses, and even commercial spaces.

This way, if one area dips, the others might still do well. It's like having a safety net for your cash.

But how do you do it right? Start small and grow slowly. Maybe buy a flat in the city and a house in the suburbs. Or try a mix of new builds and older homes. The key is to research each area well.

Look at things like local job markets and transport links. This approach can help you build a strong, varied property portfolio over time.

(Image source: Vesta Wealth)

Risks and Considerations

Investing in property isn't all sunshine and roses. You've got to keep your wits about you and watch out for a few bumps in the road.

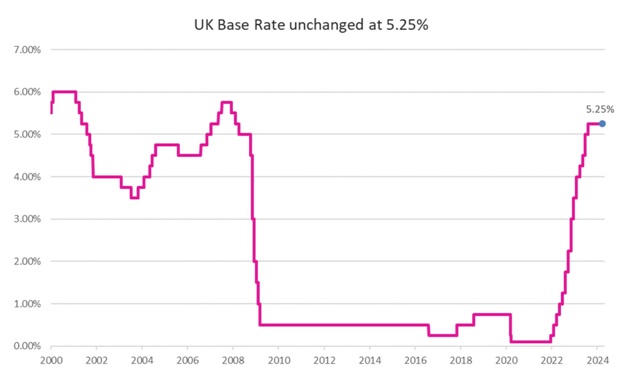

Market Volatility

Property markets can swing up and down like a seesaw. One year, house prices might soar, and the next, they could take a nosedive. This rollercoaster ride often scares off short-term investors.

But for those in it for the long haul, these ups and downs aren't as scary. They know that over time, property values tend to climb, even if there are bumps along the way.

Smart long-term investors don't panic when the market dips. Instead, they see it as a chance to snap up bargains. They keep their cool and focus on the big picture. By spreading their investments across different areas and types of properties, they can weather the storm.

This way, they're not putting all their eggs in one basket.

Regulatory Changes

Market shifts can impact property rules too. Governments often tweak laws about buying, selling, and renting homes. These changes can affect how much money you make from your property.

For example, new tax rules might cut into your profits. Or, fresh safety standards could mean costly upgrades to your buildings.

Staying on top of these changes is key for long-term success. Smart investors keep an eye on local and national policies. They plan ahead to meet new rules without breaking the bank.

This way, they can keep their properties profitable even when the rulebook changes.

Property Management Challenges

Property management can be a real headache for long-term investors. Dealing with tenants, repairs, and legal issues takes time and effort. You might face late rent payments or tricky evictions.

Keeping the property in good shape also costs money. Sometimes, you'll need to fork out cash for big repairs or upgrades.

Finding good tenants can be challenging. You'll have to screen them carefully to avoid problems down the road. Plus, you must stay on top of local laws about renting. These rules can change, forcing you to adapt your practices.

Balancing all these tasks while trying to make a profit can be tough. But with the right approach, you can overcome these hurdles and reap the rewards of property investing.

The Role of Property in a Diverse Investment Portfolio

Property plays a key role in a well-rounded investment mix. It offers a different flavour compared to stocks and bonds, adding spice to your financial recipe.

Comparing Returns with Other Investment Types

Property investments often excel compared to other options for returns. Stocks and bonds can be volatile, but bricks and mortar tend to remain stable. Over time, houses and flats have demonstrated an ability to increase in value, even during fluctuations in other markets.

This stability makes property an excellent choice for those aiming to build wealth gradually and consistently.

Comparing different investment types is challenging, but it's worth examining. While shares might experience significant fluctuations, property typically progresses at a more consistent rate.

This steady growth can help offset the volatility of other investments. Additionally, rental income provides an attractive bonus, offering property investors a regular cash flow that many other investments struggle to match.

Balancing Risk and Reward

Property investment offers a mix of risks and rewards. Smart investors know how to balance these factors. They look at market trends, choose good locations, and spread their money across different properties.

This helps them lower risks while aiming for solid returns. Revolution Finance Brokers Ltd can help with this balance. They offer special loans for buy-to-let homes and even help folks with bad credit.

Getting the right advice is key to managing risks in property deals. Local market knowledge plays a big role here. UK clients benefit from experts who know the ins and outs of British property laws and trends.

Quick access to funds through bridging finance can also help grab good deals when they pop up. This way, investors can act fast on chances that might bring big rewards later.

Conclusion

Long-term property investing remains a solid bet. History shows it's weathered storms and come out on top. Smart investors know the secret: patience pays off. With steady income and value growth, bricks and mortar offer a safe haven.

So, if you're looking for a reliable way to build wealth, property might just be your golden ticket.

Visit our calculator to see how much you can borrow, or fill in your details here to get the best offer from our agents.

FAQs

1. Why is property investment a smart long-term strategy in the UK?

Property investment in the UK has stood the test of time. It's like planting a money tree that grows slowly but surely. The housing market has its ups and downs, but over the long haul, it's been a winner. Plus, you're not just buying bricks and mortar; you're securing a piece of Blighty's future.

2. How does investing in properties compare to other investment options?

Investing in properties is the tortoise in the race of investments. It might not sprint like stocks, but it rarely trips up. Unlike the rollercoaster ride of the stock market, property values tend to climb steadily. It's a bit like having a loyal old dog – reliable, comforting, and always there when you need it.

3. What are the potential risks of long-term property investments in the UK?

No investment is without its hiccups. Property can face issues like market dips, unexpected repairs, or tricky tenants. But these are more like speed bumps than roadblocks. The key is to keep your eyes on the horizon. Remember, even the sturdiest ship can face rough seas, but it's the long voyage that counts.

4. How can I start investing in UK properties for the long term?

Starting your property investment journey is easier than you might think. Begin by doing your homework on different areas and property types. Save up for a deposit, get your finances in order, and consider chatting with a mortgage advisor. It's like preparing for a big adventure – a bit daunting at first, but exciting once you take that first step.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)