How To Leverage Your Assets to Maximise Your Investments

At Revolution Brokers, we understand that leveraging real estate is a key strategy for accelerating your growth as a property investor. Whether you're interested in real estate investing with no money upfront or looking to maximise your home equity, leveraging your assets can help you expand your portfolio and increase your returns. However, effective leverage requires strategic planning and risk management, especially in today’s shifting property market.

Here are expert strategies to help you leverage your assets and maximise your investments.

What is Leverage in Real Estate?

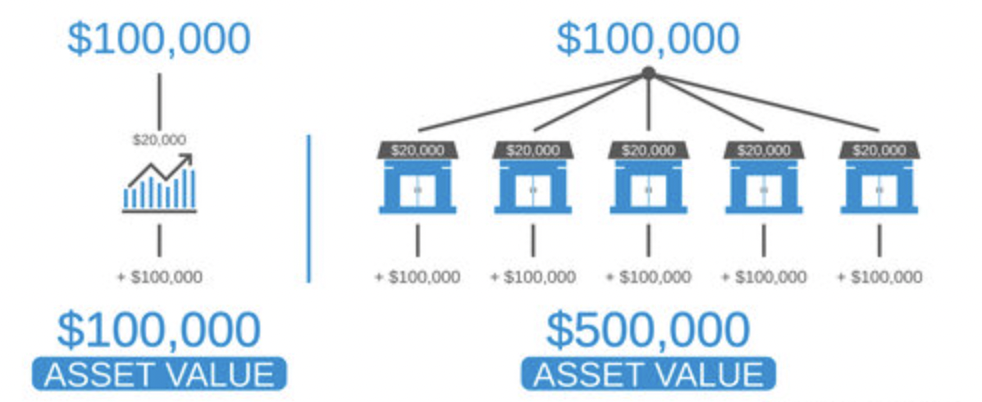

Leverage in real estate involves borrowing money to purchase or invest in properties, allowing you to control more assets with less of your own capital.By using existing assets—such as property or home equity —you can generate income or appreciation without putting down a large amount of cash upfront.

For example, investing in real estate with no money is possible through financing options that allow you to use the property itself as collateral.

Actionable Tip: When evaluating your leverage in real estate, ensure that your rental income will cover loan payments and maintenance costs. This ensures your assets generate positive cash flow, mitigating financial risks.

Image source: The Cauble Group

The Goal Is To Leverage Wisely—Not Excessively

Banks may be willing to lend you money, but just because they offer it doesn’t mean you should take it. In the current market, where interest rates are higher, excessive leverage can quickly turn a profitable investment into a liability.

Actionable Tip: Perform a financial stress test before taking on more leverage. This will help you understand how much you can afford to borrow, even in less favorable economic conditions. Be particularly cautious if you're focusing on real estate investing with no money upfront, as these deals can often involve higher risks.

How Can You Leverage Home Equity?

If you have significant equity in your home, you can leverage it to invest in more properties. This can be done by remortgaging your home to pull out cash, which you can then invest as a director’s loan into your property business. This approach can allow you to scale faster without the need for external capital.

Actionable Tip: When learning how to leverage home equity, ensure that the returns from your new investments exceed the cost of your new mortgage payments. Refinancing your home can be an excellent way to fund your property ventures, but only if your cash flow can support it.

Understand That Timing is Key

Leveraging your assets successfully depends on timing. When the property market is on the rise, leveraging allows you to grow your portfolio quickly. But in a downturn, over-leveraging can result in losses or negative equity. Being mindful of market cycles is crucial for long-term success.

Actionable Tip: Review your portfolio on a regular basis, especially if you're pursuing real estate investing with no money. You may need to reduce your leverage during times of economic uncertainty to protect your assets and avoid forced sales.

Diversify Your Leverage Across Assets

One of the best strategies is to spread your leverage across different properties and asset types. Instead of putting all your leverage into a single property, consider diversifying your portfolio. Some properties might have higher loan-to-value ratios, while others may be unencumbered, offering flexibility in tough times.

Actionable Tip: Calculate your leverage in real estate on a portfolio basis rather than property-by-property. This will help you balance risk while still taking advantage of opportunities across your holdings.

Source: iStock

Leverage Isn’t Just Financial – Time, Knowledge & Contacts Matter, Too

While financial leverage is essential, don't overlook the value of leveraging time, knowledge, and contacts. For example, partnering with experienced investors or property developers can open doors to deals you might not have access to on your own. Additionally, leveraging your professional network can help you find off-market opportunities or better financing terms.

Actionable Tip: Build relationships with key players in the industry, including mortgage brokers, property developers, and financial advisors. By leveraging their expertise, you can scale your investments with more confidence.

Final Thoughts

Leverage in real estate is one of the most powerful tools at your disposal, allowing you to control more assets and generate greater returns with less upfront capital. However, leverage must be used responsibly. By timing the market, managing cash flow, and leveraging your assets strategically, you can maximise your investments and build long-term wealth.

At Revolution Brokers, we specialise in helping investors make the most of their leverage real estate opportunities, whether through commercial property, buy-to-let, or bridging finance. Contact us today to learn how we can assist you in expanding your portfolio while managing risk effectively.

Ready to leverage your assets for success? Let Revolution Brokers guide you through your next investment.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)