The Pros And Cons Of Paying Off Your Mortgage Early

Deciding whether to pay off your mortgage early is a big choice. A key fact to know is paying it off can save you on interest costs. This article will go over the advantages of paying off mortgage early but also what could be some of the negative sides.

Keep reading to make an informed decision.

Advantages of Paying Off Your Mortgage Early

Paying off your mortgage early means living without debt and owning your home outright, resulting in reduced total loan costs.

Debt-free living

Debt-free living means you do not owe monthly mortgage payments on your mortgage anymore, giving you more money for other expenses or savings. Imagine keeping the cash that went to your mortgage lender in your pocket instead.

This change boosts your financial security and gives you greater freedom to use your income as you wish, whether for investing, retirement plans, or just enjoying life without the burden of a home loan hanging over you.

This way of living allows people to redirect what they once paid in interest rates and principal on their mortgages to building a solid financial future. Next comes understanding how this choice impacts the total cost of owning a home.

Reduced total loan cost

Paying off your mortgage early slashes the total interest you pay. This means you spend less on your home overall. Every extra dollar you put towards your mortgage is one less dollar accruing interest over time.

Instead of cash going to lenders, it stays in your pocket.

Choosing to refinance can also cut down on what you owe in the long run. Lower rates from mortgage providers mean a lower monthly mortgage payment and less spending on interest. This option requires careful thought about refinancing costs versus savings, but it's a smart move for many homeowners looking to reduce their financial load.

Owning your home outright

Owning your home outright brings a sense of security that's hard to beat. Once you pay off the mortgage, you no longer have monthly payments to the bank or mortgage company. This frees up extra money for other expenses or savings.

You also save on interest payments over time, which can add up to a significant amount. Homeownership without a loan means you fully control your property.

This financial freedom allows for easier decisions about downsizing, retirement savings, or even investing in other areas like the stock market or high-yield bonds. Next, let's explore some disadvantages of paying off your mortgage early and how they might affect your finances.

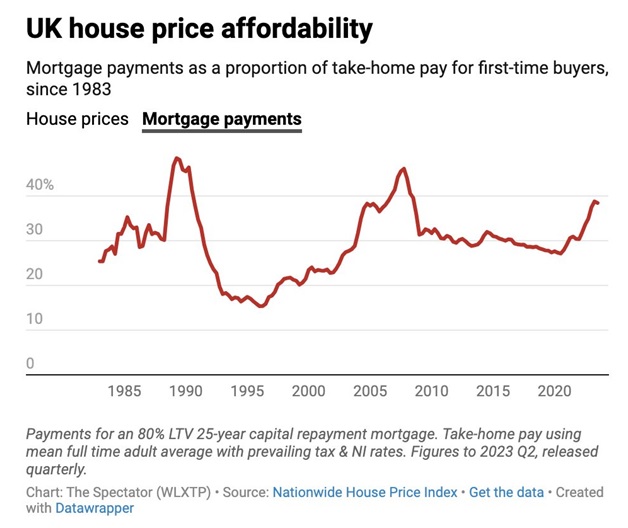

Source: X.com

Disadvantages of Paying Off Your Mortgage Early

Paying off your mortgage early can result in costly early repayment fees. Additionally, you may lose tax and interest benefits, and it could lead to neglecting higher interest debts.

Early repayment fees

Paying off your mortgage early may seem like a good idea, but it's important to be aware of potential early repayment fees. These fees can apply if you want to settle your mortgage before the agreed term, particularly with fixed-rate or discounted mortgages.

The charges associated with such fees can vary significantly depending on the terms of your mortgage agreement and the remaining balance. It's crucial to review your mortgage contract thoroughly and consult with a mortgage broker or financial advisor before making any decisions.

By paying off your home loan ahead of schedule, you could encounter early repayment penalties that might offset the benefits gained from reducing interest costs. Furthermore, understanding these potential fees can help you make informed decisions about when and how much extra payment is feasible without incurring additional expenses related to early repayments.

Loss of tax and interest benefits

Paying off a mortgage early can lead to the loss of valuable tax benefits, such as deductions for the mortgage interest rate. The tax advantages that come with paying interest on a mortgage can result in significant savings.

Additionally, individuals who pay off their mortgages early may miss out on interest benefits related to retirement accounts or other long-term investments, hindering overall wealth accumulation.

Moreover, when homeowners choose to eliminate their mortgages before schedule, they might forego a potential mortgage interest tax deduction and become subject to higher tax bills. By foregoing these benefits associated with mortgage interest payments, individuals could decrease their overall net worth and financial flexibility.

Our expert team can help you check your financial health and calculate how much you can borrow. Click the button below to choose your mortgage type and get the best deal.

Options for Paying Off Your Mortgage Early

You can pay off your mortgage early by making a full lump sum payment, remortgaging, overpaying monthly payments, offsetting savings, or seeking advice from a mortgage broker. Dive in to learn more about these options.

Make a full lump sum payment

Consider making a full lump sum payment towards your mortgage to drastically reduce the interest you'll pay over time. This single, substantial payment can significantly decrease the total loan cost, freeing you from debt sooner.

Keep in mind that using windfalls like bonuses or inheritance for this type of payment is an effective strategy for early mortgage payoff.

Remortgage

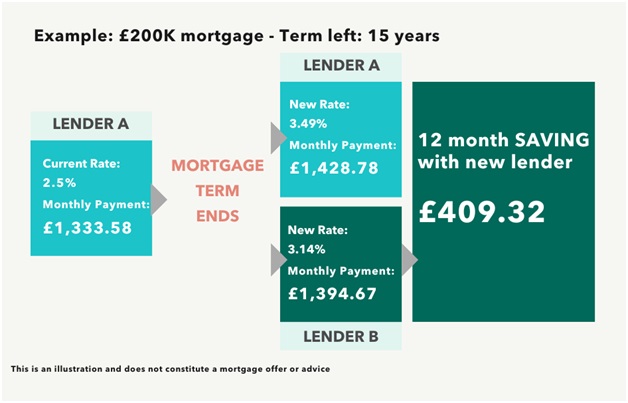

When considering the option to pay off your mortgage early, remortgaging can be a beneficial avenue to explore. Remortgaging entails switching your current mortgage deal to a new one, often with better terms and conditions.

By doing so, homeowners have the opportunity to secure lower interest rates and potentially reduce their monthly payments. Additionally, this strategy could allow you to release equity from your home for other financial needs such as home improvements or paying off higher-interest debts.

When exploring remortgage options, it's important to consider potential fees and costs associated with ending your current mortgage agreement early. However, if done strategically and under favorable market conditions, remortgaging has the potential to offer considerable long-term savings and financial flexibility.

Source: NMFinance

Overpay monthly payments

To pay off your mortgage early, you can increase your monthly payments. Doing so can help reduce the overall interest paid and shorten the loan term. By overpaying on a regular basis, homeowners can potentially save thousands of dollars in interest over the life of their mortgage.

This approach is beneficial for those who have increased income or who are looking to build equity in their homes faster. It's an effective way to gain financial freedom and start saving sooner.

Moreover, when individuals experience a decrease in income due to various reasons such as job loss or unexpected expenses, having overpaid on the monthly mortgage payments provides them with extra savings as a financial buffer during challenging times.

Offset savings

Consider utilizing offset savings to pay off your mortgage earlier. An offset mortgage allows you to link your savings and current account to your mortgage, effectively reducing the interest you pay on your home loan.

By leveraging this financial strategy, homeowners can potentially save a significant amount on their interest costs over the life of the mortgage.

This approach is beneficial because it enables individuals to use their savings and other liquidity more efficiently, as they work towards paying down their mortgage faster. By keeping funds in an offset account rather than a traditional savings account, homeowners can reduce the amount of interest payable on their mortgage while still having access to their money when needed and still have the ability to save money.

Seek advice from mortgage broker

When considering paying off your mortgage early, seeking advice from a mortgage broker can provide valuable insights and personalized strategies. A mortgage broker can assess your financial situation, offer options for early repayment, and connect you with suitable mortgage lenders.

Utilizing local independent financial advisors or services like Revolution Finance Brokers Ltd ensures that you receive tailored guidance in navigating the complexities of mortgage repayment.

By leveraging the expertise of a mortgage broker, you gain access to quick, precise, and affordable solutions that underpin informed decision-making towards achieving your goal of early mortgage payoff.

Additionally, this approach aligns with the ever-evolving realm of financial conduct and empowers you to make well-informed choices regarding your mortgage strategy.

Get instant details on your borrowing options by using our calculator. Visit the link below.

CALCULATE HOW MUCH YOU CAN BORROW

Conclusion

Paying off your mortgage early offers the advantage of debt-free living. It also means reducing your total loan cost and owning your home outright. On the flip side, there are disadvantages such as early repayment fees and losing out on tax and interest benefits.

However, you have options to consider - making a lump sum payment, remortgaging, or overpaying monthly installments. Ultimately, weighing these pros and cons can help you make an informed decision about paying off your mortgage early.

FAQs

1. What are the pros and cons of paying off my mortgage early?

Paying off your mortgage early can free up cash for other expenditures, but it may also lead to penalties from your lender or a dip in credit scores due to lower debt levels.

2. How does an early repayment mortgage impact my tax return?

An early repayment on a home mortgage might reduce tax-advantaged interests you could claim on your tax return. It's crucial to consider this before making lump sums payments.

3. Can I face any disadvantages by paying off my buy-to-let mortgage early?

Yes, one major disadvantage is prepayment penalties imposed by some banks and lending institutions. Also, you may lose out on potential capital gains if house prices rise over time.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)