How To Rent Out Your House & Buy Another

Many people dream of renting out their house to buy another. This move can be smart, but it needs careful planning. Our guide will show you how to rent your house and buy another effectively.

Keep reading to make this dream a reality.

Key Takeaways

- Understand the market to set the right rent. Look into property value trends and rental demand in your area. This helps decide how much rent you can charge.

- Calculate the financial side carefully. Consider potential rental income, costs involved in both renting out your current house and buying a new one, including stamp duty for second homes.

- Know legal and regulatory requirements. Landlords need to inform their lender about renting out their property, comply with safety regulations, and understand buy-to-let mortgage terms.

- Decide on financing options wisely. Buying with cash means no monthly repayments, whereas a mortgage spreads costs over time. For buy-to-let properties, lenders may allow borrowing up to 85% of the property's value.

- Explore let-to-buy as an option if you want to keep your current home while buying another. This requires securing two mortgages: one buy-to-let remortgage for your current home and a residential mortgage for your new home.

Assessing the Current Market

Understanding the current market is key to setting the right price for renting out your house. Looking into property value trends and rental demand will guide you on how much you can charge tenants.

Understanding property value trends

Property value trends show how much houses are worth over time. For those planning to rent out their house and buy another, it's crucial to know these trends. If your current house is worth £250,000, you might consider if its value is going up or down.

This helps in deciding when to move forward. The maximum Loan-to-Value (LTV) on a buy-to-let mortgage is 75%. It means lenders could let you borrow up to 75% of your new property's value.

Looking at the market can guide you on whether renting out your property or buying a new one makes sense now. With the right timing, both renting out your house and securing another with a mortgage become easier.

Understanding these patterns helps in making informed decisions about renting out my house and exploring rent to buy homes or properties options effectively.

Evaluating rental demand

Evaluating rental demand is crucial before you rent out your house. High demand means you could get more for your property. Look at local adverts and talk to letting agents to understand what renters want.

Factors like location, property type, and nearby amenities affect demand.

To determine how much rent you can charge, consider the impact of rental income on mortgage options. With £1,000 a month in rental income, one might afford a mortgage of up to £183,908.

This calculation assumes that the rental income must be 145% of the mortgage payment at a stress test rate of about 5%. It shows that landlords must consider their pricing strategy carefully to meet lender requirements while attracting tenants.

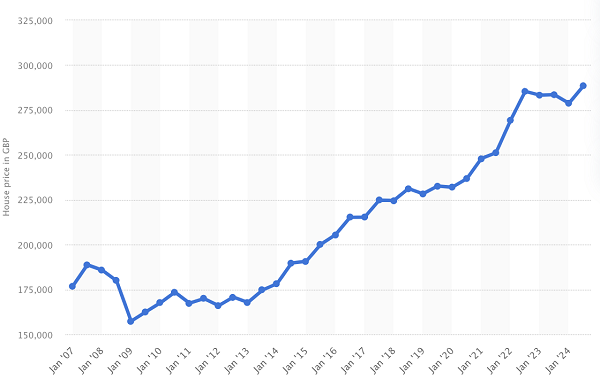

The average price of a house in the UK 2007-2023 (Source: Statista.com)

Financial Considerations

Exploring financial considerations is crucial before you decide to rent out your current house and buy another. You need to crunch the numbers thoroughly, factoring in rental income prospects and the costs involved in both transactions.

Calculating potential rental income

To calculate potential rental income, one must look at the current market rates in the area. For example, if houses similar to yours rent for £1,000 per month, this figure sets a baseline.

It's crucial that your rental income covers not just the mortgage but also maintenance costs, which might fluctuate over time. The rule of thumb is that your monthly rent should be at least 145% of your mortgage payment at a stress test rate of around 5%.

This ensures you keep ahead financially even when interest rates rise or when facing unforeseen expenses related to renting out a property.

Next comes estimating costs and profits from this venture. This step involves laying out all possible expenses against the projected £1,000/month income to see where your finances will stand.

Estimating costs and profits

Estimating the costs and profits of renting out your property requires careful consideration. For example, if you decide to remortgage your current house at £250,000, you won't need to pay any stamp duty on that amount.

However, purchasing a new home for £500,000 will incur a stamp duty fee of £30,000 due to the additional 3% charge on second homes and buy-to-let properties. This substantial cost directly impacts your budgeting for buying another property while letting out your first home.

To ensure profitability when renting out your house and buying another in the UK, calculate potential rental income against these expenses. You must also factor in ongoing costs like mortgage payments on both properties if not bought outright, maintenance fees, landlord insurance, and possible agency fees if you choose to rent my property through professionals.

These calculations help determine whether buy-to-rent or let-to-buy options align with your financial goals and offer an insight into how much rent can I get for my house compared to its operational costs.

Buy Property in Cash, Outright or with Mortgage

Choosing to buy a property with cash, outright or with a mortgage depends on your financial situation and goals. Buying in cash means you won't face monthly repayments or interest, which is a great way if you have the funds.

This approach can also make your offer more appealing to sellers, potentially securing the property at a better price. On the other hand, opting for a mortgage allows you to spread the cost over time.

For those eyeing buy-to-let investments, lending is typically based on rental income prospects.

If considering a buy-to-let mortgage for another house while renting out your current one, it's crucial to know that lenders may allow borrowing up to 85% of the property's value. For instance, with a house valued at £250,000 and aiming for this type of mortgage could see you raising £87,500 after covering an existing £100,000 mortgage.

This strategy turns equity into cash for further investment without selling off assets. Deciding between these options involves weighing immediate costs against long-term gains and market conditions.

Legal and Regulatory Requirements

Understanding the legal and regulatory requirements is crucial when renting out your property and buying another. Landlords must keep up to date with landlord obligations, buy-to-let mortgage conditions, and let-to-buy options to ensure compliance and maximise investment returns.

Understanding landlord obligations

Landlords must inform their lender if they plan to rent out their house. This step ensures the mortgage terms allow for such arrangements, directly impacting homeowners thinking about "can I rent out my house without telling my mortgage lender UK".

It is critical as failing to do so might breach the mortgage contract. They also need advice from solicitors and accountants regarding specialised SPV (Special Purpose Vehicle) lending, which is crucial when owning property outright and wanting to buy another in the UK.

Legal duties also extend beyond financial declarations. Safety regulations demand landlords conduct gas safety checks annually, provide energy performance certificates, and install smoke alarms on each floor of the rented property.

These steps are part of ensuring a home let meets legal requirements, safeguarding both tenant and landlord interests in the renting sector.

Navigating Buy-to-Let Mortgages

Getting a buy-to-let mortgage lets long-term investors use their existing property to step into the rental market. This type of mortgage is different from regular ones because you can only borrow up to 75% of your property's value for buy-to-rent purposes.

It means that if you own a house outright and want to buy another in the UK, this could be your path to expanding your property portfolio.

Investors need to prove that potential rental income will cover mortgage payments by a certain percentage, often around 125%-145%, depending on the lender. This requirement ensures landlords can manage mortgage costs even if the rent-to-buy property faces vacancies.

With careful planning and understanding of these terms, securing a buy-to-let mortgage becomes an achievable goal for those looking to rent out their first home or add another house to their investment collection.

Let-to-Buy Options for Homeowners

Moving from the puzzles of buy-to-let mortgages, homeowners have another appealing option: let-to-buy. This situation allows a homeowner to retain their current property and rent it out while acquiring a new home.

It involves securing two separate mortgages – a buy-to-let remortgage on the present property and a residential mortgage for the new house.

Homeowners should initially get permission to let from their current lender before switching to this scheme. Let-to-buy presents a wonderful opportunity for those aiming to broaden their investment portfolio without getting rid of assets.

With thoughtful planning, individuals can produce rental income from one property while relishing the benefits of living in another, effectively handling both investment and personal residence aspirations at the same time.

Conclusion

Renting out your house while buying another is a smart move for many homeowners. It opens up the door to additional income and investment opportunities. With the right guidance, understanding legal requirements, and financial planning, you can make both properties work for your future.

Consulting with professionals will smooth out the process. This strategy offers a way to grow your assets and navigate the property market confidently.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)