What Is The Smallest Mortgage You Can Get

Buying a home can feel like a giant step, especially in finding the right mortgage. In the UK, you can get small mortgage loans starting from as low as £10,000. Our article will guide you through securing the smallest mortgage possible that suits your financial situation.

Exploring Minimum Mortgage Amounts in the UK

Finding out the lowest amount you can borrow for a home loan in the UK requires understanding what mortgage providers are willing to offer. They look at your earning and spending habits, how much money you can put down, your creditworthiness, and what type of house you want to buy.

Lender Preferences and Requirements

Lenders set their own rules on the smallest mortgage they will offer. Some may go as low as £25,000 while others start at £50,000 or even higher. They also look for a minimum property value, often around £40,000.

These preferences aim to reduce risk and ensure that the borrowing aligns with their lending policies. Mortgages under $60,000 are especially tough to find because many mortgage providers see them as less profitable compared to larger loans.

Banks and other lenders require borrowers to meet specific criteria before approving a mortgage. This includes checking credit scores, reviewing income levels, and assessing loan-to-value ratios.

The better your credit score and financial standing, the more likely you are to secure a favorable mortgage rate from these institutions.

Impact of Income and Outgoings on Mortgage Size

Income and outgoings play a massive role in deciding how much you can borrow for a mortgage. Banks look at your cash flow to ensure you can handle monthly repayments. A steady job and a history of working for two years make you more appealing to lenders.

Your spending habits also impact the loan amount banks will offer. Banks see this as a good sign if you spend less than you earn and manage debts wisely. This includes keeping credit card debts low and not having too many unsecured loans hanging over your head.

On the other hand, high outgoings compared to income might reduce the size of the mortgage banks think you can afford. Making a down payment of at least 20% could improve your chances of getting approved for bigger loans, though some financial institutions may accept down payments as low as 5%.

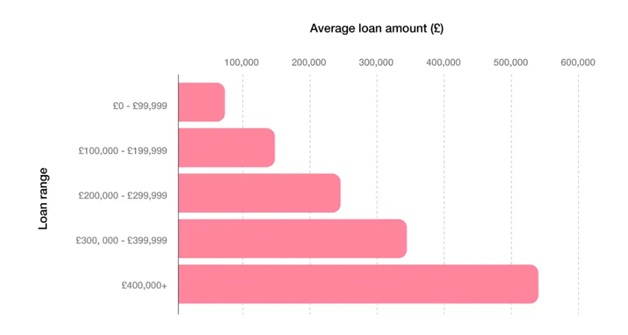

Source: Uswitch [average mortgage amount in the UK]

If you have decided on a down payment to increase your chances of getting a mortgage, you can consult with our team and get the best deal for your.

Importance of Loan-to-Value Ratios

Loan-to-value (LTV) ratios play a key role in mortgage approvals and interest rates. A lower LTV ratio means you have a larger deposit on your potential home, which makes lenders see you as less risky.

This can lead to better interest rates for your mortgage. For example, with a typical smallest deposit of 5% of the house price, your LTV ratio would be high, often leading to higher interest costs.

Specific schemes offer zero deposit options, directly affecting the LTV ratio by making it possible to buy a home without the initial large sum normally required. This changes how banks view your loan request and can influence their decision on whether to lend money or not.

Role of Credit Score in Mortgage Approvals

A high credit score means better deals on mortgages. Lenders often look for a minimum score of 620 before they say yes to a loan. Your credit history shows them if you can handle the money they lend you.

It includes your past loans, how well you paid back debts, and even your credit card use. A good score could get you lower interest rates or more money. Finding a lender might be harder but not impossible if your credit is bad. Some mortgage products are still within reach. You can work on improving your score by paying bills on time and keeping debt low.

Influence of Property Type on Mortgage Amounts

Source: USwitch, [Average mortgage by type of property]

These experts have deep knowledge about everything from first mortgages to refinancing and can match you with the right financial product to meet your needs with the best mortgage deals.

Property type has a big role in how much you can borrow for a mortgage. Lenders often set minimum property values, usually around £40,000. This means if you want to buy a tiny house or a condo, your options for small mortgages might look different.

The kind of home you choose affects not just the loan amount but also the interest rates and what you need to qualify. Interest rates and qualification requirements change with different types of properties. For example, buying a single-family home versus an investment property like a buy-to-let mortgage comes with various rules.

Lenders see some properties as higher risk, which may mean they'll lend less money or ask for higher interest rates compared to others. So, choosing between living in Southfields or eyeing that ideal second home could influence your mortgage terms significantly.

What Is the Minimum Mortgage You Can Borrow in the UK?

In the UK, small mortgage loans start at £10,000. This amount is what some lenders set as their lowest for a mortgage or remortgage. However, many banks and mortgage providers often require a minimum mortgage loan amount of £50,000.

These figures can vary based on the lender's policies and the borrower's financial health. For properties, lenders may insist on a minimum mortgage loan value typically around £40,000 to consider granting a loan.

This ensures that the property covers the amount lent in case it needs to be repossessed.

Boosting your deposit and maintaining an impressive credit score play big roles in qualifying for these small mortgages. Also important are your income level and outgoing expenses which determine how much banks are willing to lend you for buying a home or refinancing your existing dwelling place.

Do you want to get the minimum mortgage amount possible?

Tips for Securing the Smallest Possible Mortgage

Finding the smallest mortgage starts with understanding your finances and what lenders look for. You want to show you're a safe bet by having a solid credit history and a stable income.

Planning plays a big part, too; use tools like online calculators to figure out how much house you can afford without stretching your budget too thin.

Talking to a mortgage advisor can also guide you through different lending options, whether it's fixed-rate home loans or government-backed finance plans like those from the Federal Housing Administration.

They can help spot ways to reduce borrowing costs, such as choosing shorter loan periods or making larger down payments. In short, get your financial ducks in a row and seek expert advice to land the smallest mortgage that works for you.

Account for All Potential Costs and Fees

Planning for every cost and fee is a must when you're aiming for the smallest mortgage possible. This means not just looking at the price tag of the home, but also factoring in extra expenses like setup charges, property checks, lawyer's bills, and Stamp Duty.

Knowing all your costs helps you see the full picture of what you'll owe. For mortgages, this includes not just your monthly mortgage repayments but also closing expenses and interest rates that affect how much you pay back over time.

Selecting the Optimal Mortgage Plan

Choosing the best mortgage plan involves comparing different types of home loans, interest rates, and lender requirements. Look at fixed-rate mortgages for stable monthly payments over the years.

Consider variable-rate options if you expect your income to increase or if you plan to move soon. Each choice has its pros and cons, depending on your financial situation and long-term housing plans.

Consulting with a mortgage broker can also guide you through the process of picking a suitable loan option. They have access to various mortgage lenders and can offer advice based on your credit report, debt-to-income ratio, and down payment size.

Consulting with Mortgage Professionals

After figuring out the best mortgage plan, talking to mortgage professionals is a smart move. Mortgage brokers know the ins and outs of getting a home loan. They offer advice that fits your situation perfectly.

Revolution Finance Brokers Ltd is a great resource. We specialise in finding financing solutions even if your credit history isn't perfect or if you're exploring property investments like buy-to-let mortgages while climbing on the property ladder.

These experts have deep knowledge about everything from first mortgages to refinancing and can match you with the right financial product to meet your needs with the best mortgage deals.

FAQs

1. What is the smallest mortgage you can get?

The smallest mortgage amount varies, but it's typically linked to factors like your credit history, income and the loan-to-value ratio of the property.

2. Can I get a small mortgage loan in the UK?

Yes, there is a minimum mortgage amount in the UK. You may need financial advice to understand how much banks lend for mortgages based on your situation.

3. How does my credit history affect getting a small mortgage?

Banks and credit card companies check your credit histories during underwriting. A good score helps secure lower interest rates and better terms.

4. Can I refinance or get a second mortgage if I have a small initial loan?

Refinancing or obtaining a second mortgage depends on several factors including home equity, current income, and existing debt levels.

5. Are there special loans for people with lower incomes looking for smaller mortgages?

FHA loans are available for those with lower incomes seeking smaller mortgages; they require less collateral but might involve private mortgage insurance premiums.

6.What should homeowners remember when trying to secure a small-mortgage loan?

Homeowners should consider their savings, investments, tax returns as well as checking account status before applying for any kind of mortgaged transaction such as personal loans or bridging loans.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)