Unlocking Hidden Value In A Property: Actionable Insights for UK Investors

When investing in commercial property, the key to success often lies in spotting hidden potential where others see limitations.

At Revolution Brokers, we believe that the best property deals are those where you can unlock value others might miss.

In this blog post, we’ll share insights from a recent case study. The study shows how a seemingly unworkable property was transformed into a profitable venture, highlighting the potential of investment properties and how you can do the same.

Understanding the UK Property Market

Navigating the UK property investment market can be complex, but understanding its intricacies is crucial for making informed investment decisions. Many factors, including economic conditions, government policies, and demographic shifts, all influence the market. Here are some key elements to consider:

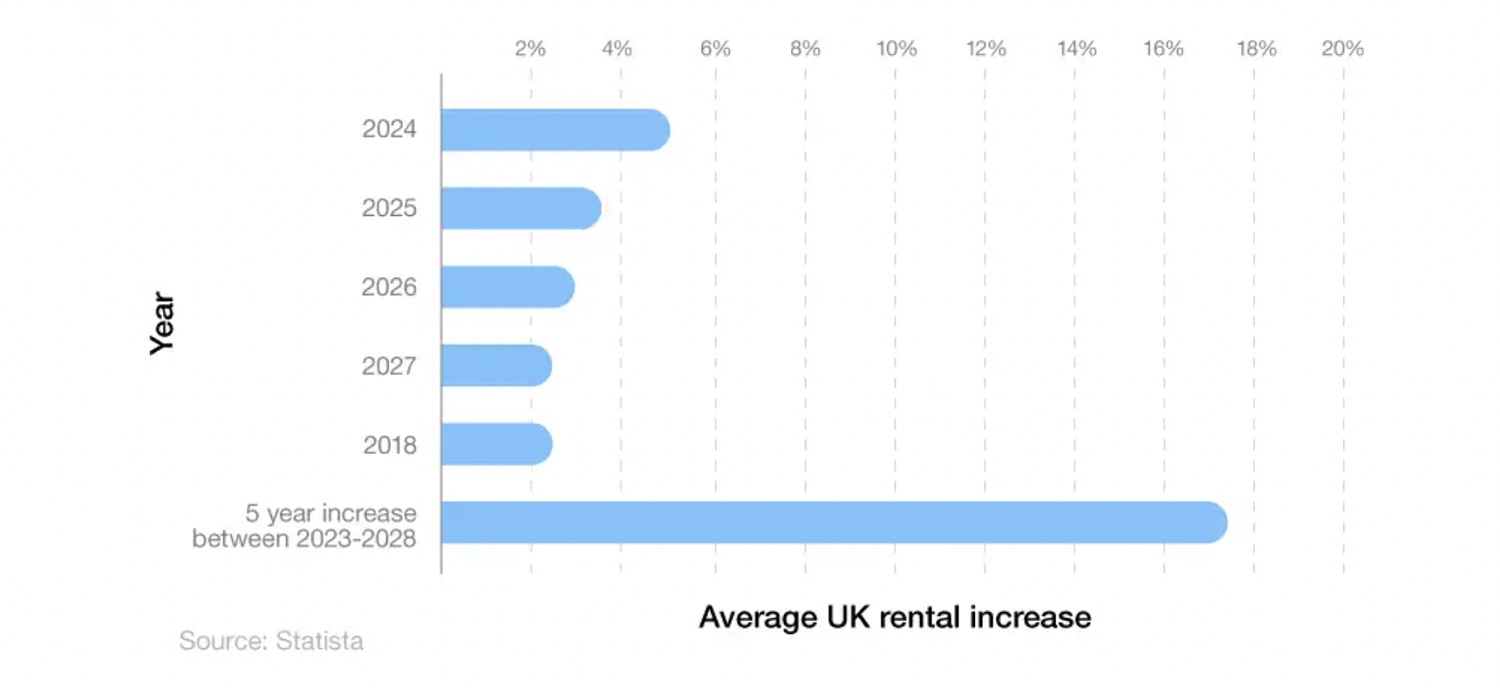

- Market Trends: The UK property market has seen significant growth in recent years, driven by low interest rates, government incentives, and a persistent housing shortage. However, it’s essential to recognize that the market can be volatile. Staying informed about current trends and potential risks is vital for any property investment strategy.

- Regional Variations: The UK property market is far from uniform. For instance, London and the South East are known for their high property prices and competitive nature, while regions like the North and Midlands offer more affordable investment opportunities. Understanding these regional differences can help you tailor your investment approach to suit specific market conditions.

- Property Types: The market offers diverse investment opportunities, from residential and commercial properties to industrial spaces. Each type comes with its own set of advantages and challenges. For example, residential properties might offer stable rental income, while commercial properties could provide higher returns but come with more significant risks.

- Regulatory Environment: The UK government has implemented various regulations that impact the property market, such as stamp duty land tax, capital gains tax, and rent controls. Awareness of these regulations and how they affect your property investments is crucial for long-term success in property investing.

By understanding these factors, you can better navigate the complexities of the UK property market and make more informed investment decisions. Need to check how much you can borrow? Use our calculator below.

Calculate How Much You Can Borrow

Seeing What Others Don’t in Property Investment

When this property hit the market, many potential investors dismissed it. The building, a former bank, comprised a ground-floor banking hall, office space on the first floor, and staff kitchens and toilets on the second. The property purchase involved carefully considering the financial and regulatory aspects of acquiring such a unique investment. Most saw the upper parts suitable for a single duplex maisonette, but the numbers didn’t add up. The total floor space wasn’t sufficient for this configuration, and the ceiling height on the second floor fell short of the minimum requirements for a comfortable living space.

Source: Uswitch

But at Revolution Brokers, we saw things differently. Rather than one large maisonette, we envisioned the space divided into two one-bedroom flats, maximising the property's value. With some creative problem-solving, what seemed like a poor investment to others suddenly became an opportunity.

Property Investment Strategy Challenges & Opportunities

One of the biggest challenges with older commercial buildings is the accumulation of changes made by previous tenants. Over the years, this building had been altered multiple times, with walls being “battened out” to accommodate air conditioning, chimneys, and other modifications. Each change had eaten away at the available floor space, making the property seem smaller than it was.

We stripped everything back to brick, reclaiming valuable square metres. By removing unnecessary chimney breasts and redundant walls, we created the space needed to meet the minimum requirement of 37 square metres for a one-bedroom flat. This is a crucial lesson for investors: sometimes, you must look beyond what’s in front of you and consider how the residential property can be reimagined.

Floor Height Challenges for Rental Income

The second major hurdle was the low ceiling height on the second floor. At under 2.1 metres, it didn’t meet the standard for a residential flat, making it unsuitable for comfortable living. While many investors walked away because of this issue, we found a simple yet effective solution—lowering the floor on the first floor to give the second floor the required 2.3-metre ceiling height.

By adjusting the placement of floor joists and moving a staircase, we created sufficient height for two well-proportioned one-bedroom flats, making them ideal for rental property and unlocking the potential others had overlooked.

Why Knowledge is Key to Spotting Opportunities

The key takeaway here is that investing in commercial property isn’t just about the numbers on the surface. To truly succeed, you need to develop an eye for hidden value. Many investors saw only the limitations of this property.

Still, by equipping ourselves with the knowledge of building regulations and creative space utilisation, we were able to transform it into a profitable development. Understanding these aspects is crucial for anyone considering real estate investment, as it allows for more informed decisions and better property utilization.

At Revolution Brokers, we encourage investors to look beyond the obvious. If an opportunity is easy to spot, the price will likely reflect that. The real gains are made when you can see value that others miss.

Benefits of Property Investment

Investing in property can offer a multitude of benefits, making it an attractive option for many investors. Here are some of the key advantages:

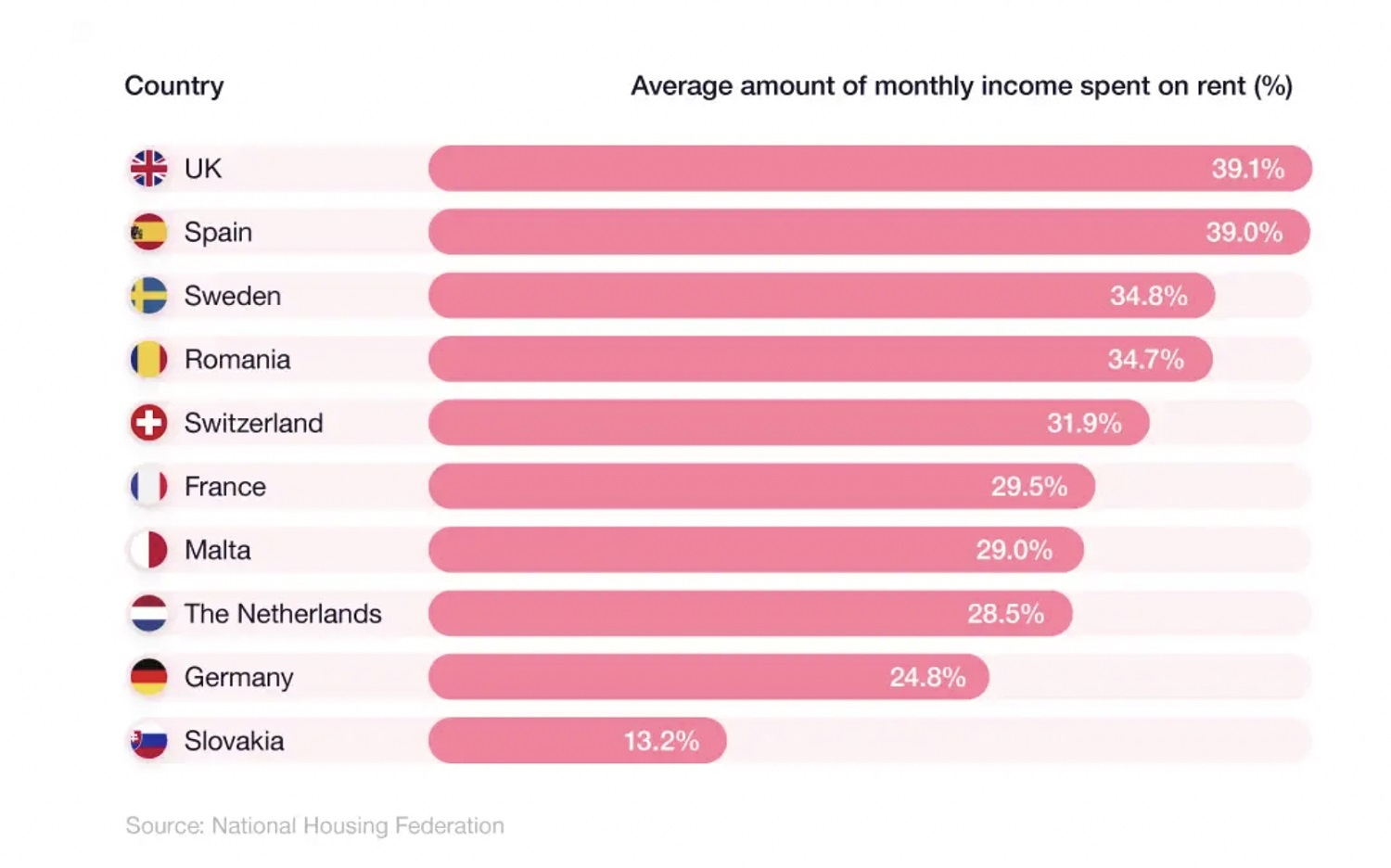

- Rental Income: One of the primary benefits of property investment is the potential for generating a steady stream of rental income. This can provide a relatively stable source of returns, especially in high-demand areas.

- Capital Appreciation: Over time, property values can increase, offering the potential for significant capital growth. This appreciation can be a substantial source of long-term wealth, particularly in regions with strong market fundamentals.

- Tax Benefits: Property investment can come with various tax advantages. For instance, mortgage interest relief and exemptions on capital gains tax can enhance the overall profitability of your investment.

- Diversification: Adding property to your investment portfolio can provide diversification benefits. By spreading your property investments across different asset classes, you can reduce risk and improve the stability of your returns.

- Physical Asset: Unlike stocks or bonds, property is a tangible asset. This physical presence can provide a sense of security and control, as you can directly manage and improve the property to increase its value.

These benefits make property investment a compelling option for those looking to build wealth and achieve financial stability. Not sure how to proceed? Request a callback and our expert team will advise you on the best next steps.

How to Maximise Your Rental Income

For many property investors, maximizing rental income is a key objective. Here are some strategies to help you achieve this goal:

- Choose the Right Location: Location is paramount when it comes to rental income. Properties in areas with high demand, good transport links, and ample amenities tend to attract more tenants and command higher rents.

- Select the Right Property Type: Different property types can yield varying levels of rental income. For example, multi-bedroom houses and apartments often generate higher rents compared to studios or one-bedroom flats. Understanding the local rental market can help you choose the most profitable property type.

- Set the Right Rent: Setting the appropriate rent is crucial for attracting tenants and maximizing income. Conduct thorough research on local rental prices and consider the competition to ensure your property is priced competitively.

- Manage the Property Effectively: Effective property management is essential for maintaining high occupancy rates and ensuring tenant satisfaction. Whether you choose to manage the property yourself or hire a property management company, good management practices can significantly impact your rental income.

- Maintain the Property: Regular maintenance is vital for preserving the property’s value and appeal. Budgeting for ongoing repairs and improvements can help you attract and retain tenants, ultimately boosting your rental income.

By implementing these strategies, you can enhance your rental income and achieve greater returns on your property investment.

Source: Uswitch

Learn How to Check the Property Value to Unlock Hidden Value

If you’re interested in learning how to spot these kinds of opportunities for yourself, Revolution Brokers offers comprehensive training on commercial property investment and development. We cover everything from property conversions to maximising your pension through commercial property investments. By learning to invest in property, you can equip yourself with the proper knowledge to identify hidden potential and make savvy investment decisions that others might overlook.

Join us at the next Baker Street Property Meet, the UK’s largest property investor networking event, where you’ll learn from industry experts and network with like-minded investors. It’s not just about what you know—it’s about who you know. Connecting with the right people can transform your property journey into a monumental success.

Stay ahead in today’s shifting property market by learning the skills needed to spot opportunities where others see limitations. Revolution Brokers is here to help you make those opportunities a reality.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)