What Is A Homeowner Loan?

Exploring homeowner loans helps you grasp how they work and what sets them apart from other types of borrowing. Keep reading to learn who are homeowner loans suitable for and find out more about making savvy financial choices with homeowner loans.

Defining Homeowner Loans

Homeowner loans, often referred to as home equity loans or second mortgages, offer a way for individuals to borrow money by using their property as collateral. This type of loan allows homeowners to tap into the value of their homes, providing access to larger loan amounts up to £500,000.

The duration for repaying these loans can extend from 1 year up to an impressive 35 years. Opting for homeowner loans means leveraging the equity built in your home which can serve various financial needs.

A Secured homeowner loan stands out because it usually offers more favorable terms compared to unsecured loans, including lower interest rates and higher borrowing limits. This is primarily due to the security that the borrower’s property provides to lenders.

Whether you’re looking at consolidating debt with bad credit homeowner loans or planning major home renovations, these secured loans present a viable solution. By securing the loan against your property, lenders have added assurance which in turn opens up pathways even for those seeking homeowner loans for poor credit history.

Unlocking the value of your home through a homeowner loan can provide significant financial flexibility and opportunities.

Comparison with Other Loan Types

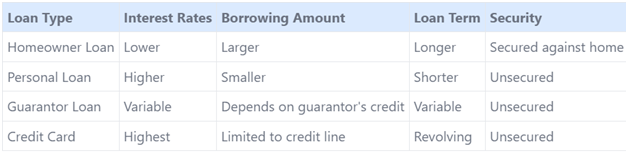

Having defined homeowner loans, we now explore how they stack up against other types of loans. This comparison emphasizes key differences in terms, interest rates, and borrowing capabilities.

This table shows that secured homeowner loans generally offer the advantage of lower interest rates and the ability to borrow more money over a longer period than unsecured loan options like personal loans, guarantor loans, and credit cards. The requirement of securing a loan against a home helps in obtaining these favorable terms.

The Mechanics of Homeowner Loans

Discover how homeowner loans work and see why they might be the right choice for your financial needs.

Steps to Secure a Homeowner Loan

Securing a homeowner loan can be a straightforward process if you follow the necessary steps. Here's how you can get started on securing financing that leverages the equity in your home.

- Check your credit score to ensure it meets the lender's requirements for homeowner loans. A good credit score increases your chances of approval.

- Determine how much equity you've built up in your home since this will affect the amount you can borrow.

- Use a homeowner loans calculator to estimate how much you can afford to borrow and what your monthly loan repayments might look like.

- Research various homeowner loans direct lenders to compare interest rates, terms, and fees. Look for the best homeowner loans that match your financial situation.

- Gather all necessary documentation, including proof of income, identification documents, mortgage details, and evidence of home equity.

- Apply for pre-approval with your chosen lender to see if you meet their initial eligibility criteria for homeowner loans UK.

- Undergo a detailed credit and affordability check as required by the lender to finalize eligibility for the loan.

- Carefully review the loan offer, paying close attention to the interest rate, repayment period, and any additional charges or fees.

- If satisfied with the offer, accept it and complete any further paperwork required by the lender to process the homeowner loan.

- Prepare for closing by confirming all necessary documents are signed and understanding when and how funds will be disbursed.

Following these steps can help streamline the process of securing a homeowner loan, whether you're looking to fund home renovations or consolidate debt, even if searching for homeowner loans bad credit options, or unsecured personal loan opportunities.

Repayment Methods

Homeowner loans require borrowers to make regular monthly repayments over the life of the loan. These payments depend on several factors like the size of the loan, the term length, and the value of your property.

The interest rate on these loans can vary, affecting how much you have to pay back each month.

Failing to keep up with these monthly repayments could hurt your credit score and even risk losing your home. Lenders will take into account your ability to repay before offering you a homeowner loan for bad credit or any other situation.

Next, we will explore the advantages and disadvantages of taking out a homeowner loan.

Advantages and Disadvantages

One of the standout advantages of homeowner loans is their ability to offer larger borrowing amounts coupled with lower interest rates and longer repayment terms. This makes them an attractive option for individuals needing substantial funds without the high costs associated with other loan types.

These benefits stem from the fact that these loans are secured against your home, providing lenders with added security and enabling borrowers to access better financial terms.

On the flip side, securing a loan against your home carries the significant risk of repossession if repayments are not maintained. Some homeowner loans come with variable interest rates, which can increase unpredictably over time, impacting monthly repayment amounts.

Potential borrowers should also be aware of other costs such as arrangement fees, valuation fees, broker fees, and charges for early repayment that could add up and affect the cost-effectiveness of taking out a homeowner loan for bad credit or any purpose.

Selecting the Right Homeowner Loan

Picking the best homeowner loan requires careful thought about your needs and financial situation. Checking your eligibility and understanding what paperwork you'll need can save time and guide you to a suitable option.

Key Considerations

Before securing a homeowner loan, carefully assess the risk of home repossession if repayments are missed. This critical factor underlines the importance of having a stable repayment strategy in place.

Interest rates on loans can be variable, meaning they might increase or decrease during the term of the loan. Therefore, consider how fluctuations could affect monthly payments and overall financial planning.

Evaluate the 'total amount payable' over the life of the homeowner loan to understand fully how much will be repaid in total, including interest and any possible fees. This step ensures transparency and helps compare different loan offers effectively.

Next, delve into understanding qualification criteria for a smoother application process.

Qualification Criteria

Qualification criteria for homeowner loans focus on the borrower's credit history, income, outgoings, and the equity they have in their home. Lenders assess these factors to determine loan eligibility.

Your credit score plays a crucial role as it influences the borrowing amount, interest rates offered, and terms of the loan. Homeowners with bad credit might still secure a loan but should expect higher interest rates.

Companies like Compare the Market make it easy to check your eligibility for homeowner loans; they can conduct checks in less than 4 minutes. This quick process helps borrowers understand their standing without having to commit significant time or face initial rejections based on basic criteria.

Necessary Documentation

After meeting the qualification criteria for a homeowner loan, gathering the necessary documentation is your next step. This paperwork is crucial for lenders to assess your application.

- Proof of identity: Lenders will ask for government-issued identification like a passport or driver's license to verify who you are.

- Proof of income: You must provide recent pay stubs, bank statements, or tax returns to prove your income level. This information helps lenders determine your ability to repay the loan.

- Mortgage statement: Present your latest mortgage statement. It shows the current balance on your mortgage, helping lenders understand how much equity you have in your home.

- Property details: Include details about your property that secure the loan such as purchase date, property type (e.g., single-family home, condo), number of bedrooms, property value assessment, and any other relevant information.

- Credit report authorization: Although not a document you provide, be ready to authorize lenders to pull your credit report. This gives them insights into your bad credit history and score which is especially important if seeking homeowner loans for bad credit rating.

- Home insurance proof: Demonstrating that you have sufficient home insurance is often required by lenders to protect their investment in case of damage to the property.

- Legal paperwork related to the property: Depending on jurisdictional requirements and the nature of the loan, additional legal documents relating to the ownership and status of the property might be needed.

These documents collectively allow lenders to gauge both your financial health and the value of the collateral securing the homeowner loan. Ensure all documents are current and accurately reflect your financial situation for a smoother application process.

Popular Applications of Homeowner Loans

Homeowner loans give people the power to turn their house dreams into reality. They use these funds for big projects like making their homes better or starting a new business venture.

Funding Home Renovations

Homeowner secured loan offers the perfect solution for homeowners looking to revamp their living spaces. With borrowing amounts that can range from £10,000 to £500,000, these loans provide ample funds to tackle any renovation project, big or small.

Homeowners can transform their kitchens, update bathrooms, or add extensions without the immediate financial burden.

These loans are especially beneficial for significant renovations that increase a home's value over time. The money borrowed is secured against your property, giving lenders confidence and often leading to more favorable interest rates compared to unsecured loans.

This means you get the necessary funding while potentially saving on homeowner loan cost in the long run.

Homeowner loans turn big dreams into achievable plans.

Consolidating Debt

Using homeowner loans for debt consolidation can smartly combine multiple debts into one manageable loan. This approach simplifies repayment processes and might offer lower interest rates than those of existing debts.

Nonetheless, it's crucial to consider that consolidation may extend the length of your debt terms, potentially increasing the total amount you repay over time.

Next, we'll explore how homeowner loans can ignite the launch pad for financing a new business, showcasing another versatile application of this financial tool.

Financing a New Business

Homeowner loans offer a solid foundation for entrepreneurs aiming to start or expand their new business. With Evolution Money providing dedicated business investment loans, individuals find an accessible route to secure the necessary funds.

These loans harness the equity in one’s home, translating into potentially larger borrowed amounts than unsecured loan options might allow.

This financial approach benefits those needing substantial capital to cover initial costs or scale operations effectively. It allows homeowners to leverage their property's value, opening doors to opportunities that could transform a small venture into a thriving enterprise.

Supporting Relocation Costs

Just as financing a new business can be pivotal for growth, covering the costs of relocating is another popular way to use homeowner loans. These loans offer financial flexibility for moving expenses, allowing borrowers to transition smoothly without depleting their savings.

By tapping into the equity of your home, you secure funds that can cover everything from hiring movers to paying for the security deposit on a new lease.

It's crucial for borrowers to approach this option with caution. Failure to repay the loan can lead to serious consequences, including home repossession. This method provides a practical solution for managing relocation costs efficiently while keeping your most valuable asset – your home – at risk if obligations are not met on time.

Conclusion

Homeowner loans offer a powerful way for borrowers to tap into the equity of their homes, providing access to larger sums of money with potentially lower interest rates. By securing the loan against property, homeowners gain the flexibility to finance big projects or consolidate debts under more favorable terms.

It's crucial that borrowers understand their repayment obligations, as missing payments can have serious consequences, including home reposession. Choosing the right homeowner loan requires careful consideration of one’s financial situation and future plans.

Armed with knowledge and attention to details like fees and eligibility criteria, homeowners can make informed decisions that align with their long-term financial goals.

FAQs

1. What is a homeowner loan?

A homeowner loan is money that you borrow using your home as security against the loan.

2. Who can apply for a homeowner loan?

Only people who own their homes can apply for a homeowner loan.

3. How does a homeowner loan work?

When you get a homeowner loan, the lender uses your house as protection if you cannot pay back the money you borrowed.

4. Can I use a homeowner loan for anything?

Yes, you can use a homeowner loan for many things like fixing up your house or paying off other debts.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)