Top Investment Strategies For Beating 2024's Inflation In The UK

Many people worry about how inflation will eat into their savings by 2024. A study shows that by November 2023, UK inflation could be hitting your pocket hard. This article explores where to invest to beat inflation in the UK in November 2024 - IG UK, offering you smart strategies and options.

Get ready for some eye-opening tips!

Key Takeaways

- Gold serves as a strong hedge against inflation, maintaining its value when currencies fall. Investing in gold through ETFs and ETCs provides UK investors with an accessible option to protect their savings.

- Real Estate Investment Trusts (REITs) and commodities like oil and grains are solid choices for combating inflation. REITs offer dividends from property incomes, which often rise with inflation. Commodities act as early indicators of rising prices.

- Spread bets and Contracts for Difference (CFDs) allow trading on price movements without owning the asset. These carry high risks but can be part of a strategy to beat inflation if used wisely.

- Value stocks and inflation-linked bonds adjust payouts based on inflation rates, offering protection for investors' returns against the diminishing purchasing power caused by rising costs.

- Historical examples of hyperinflation, such as those seen in Zimbabwe and Venezuela, underline the importance of strategic investment to safeguard finances during economic instability.

Understanding Inflation and its Impact

Inflation eats away at the value of money, making goods and services more expensive each year. It affects how much you can buy with your wages or savings, pushing investors to find ways to keep their wealth from shrinking.

The impact of high inflation in 2024

High inflation in 2024 means every pound buys less than before. This happens because production costs and wages go up. It also rises when consumer demand increases, making people willing to pay more for what they need or want.

With higher prices, savings could lose their value over time, making it harder for everyone to keep up with the cost of living.

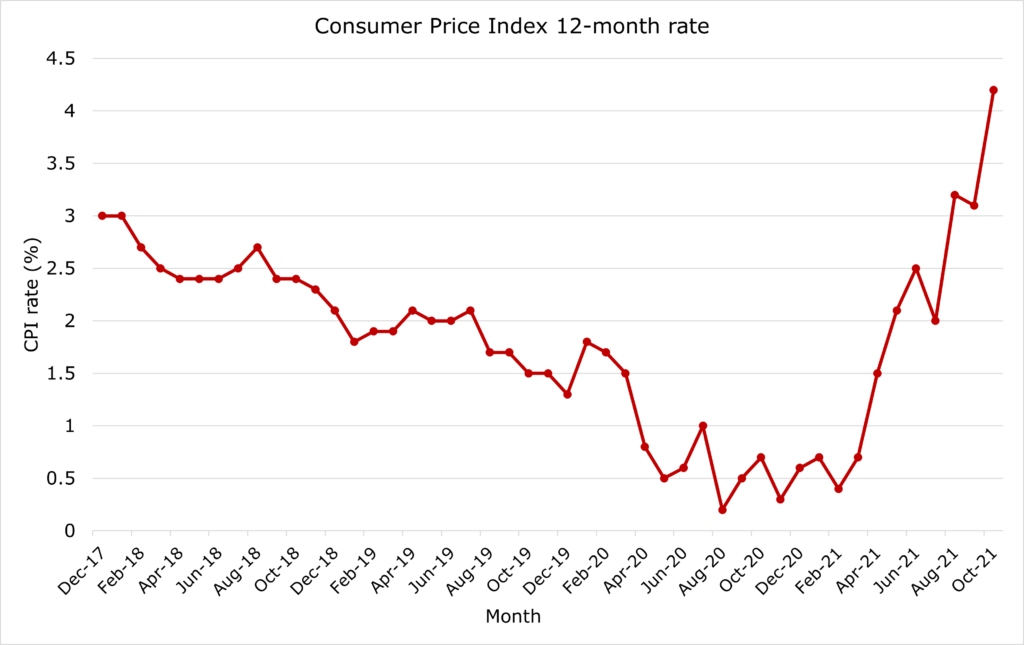

Inflation is tracked by the Consumer Price Index (CPI), which will likely show how much more expensive things have become. If inflation keeps rising as expected, finding ways to protect savings from inflation in the UK becomes crucial.

Everyone needs strategies for investing during inflation to ensure their money retains its buying power despite these challenges.

Theory of inflation

As we transition to analysing the implications of high inflation in 2024, it's pivotal to comprehend the concept underlying it. Inflation occurs when the money supply in an economy expands quicker than its production of goods and services.

This disparity results in an increase in prices for goods and services. Numerous economic factors can prompt this surge in money supply, consisting of government fiscal regulations that may entail escalating public expenditure or modifying tax rates.

For example, if a government opts to release more money without a corresponding augmentation in goods and services, prices are liable to shoot up. This happens because a larger amount of money will be pursuing the same quantity of products, leading to the situation commonly referred to as "excessive money pursuing limited goods." Furthermore, external constituents like rising import costs can also instigate inflation by escalating the expenditure for businesses to produce goods, thereby transferring these costs to consumers via increased prices.

Comprehending these aspects is essential for investors who are investigating methods to counteract inflation across the UK by pinpointing inflation-resistant investments that can endure these pressures.

Statistical data on inflation

Moving from the theory of inflation, we now focus on actual figures to understand its impact better. Inflation has surged 126% from 1991 to 2021 in the UK. This significant rise means that everyday items have doubled in price over thirty years.

For example, a loaf of bread that cost 54p in 1991 had its price jump to £1.08 by 2021.

Looking at a more extreme case, Zimbabwe experienced an unimaginable inflation rate of 79.6 billion percent in November 2008. These statistics show how critical it is for individuals and investors in the UK to find effective strategies for beating inflation and protecting their savings and investments against such drastic rises in prices.

Investment Strategies for Beating Inflation

Mastering the right investment strategies can help you stay ahead of inflation's curve. Exploring diverse options like spread betting, commodities, and real estate offers solid paths to protect and grow your wealth in uncertain times.

Spread bets and CFDs

Spread bets and CFDs are mechanisms investors utilise to combat inflation in the UK. With these, the asset is not in possession, but rather a wager on its price fluctuations. Due to leverage, they carry significant risks which can rapidly amplify both profits and losses.

A crucial statistic is that 69% of retail investor accounts incur losses when trading these instruments. This underlines the necessity for a careful approach and comprehensive understanding before getting involved in this investment sector.

The charm of spread bets and CFDs dwell in their adaptability across various financial markets. They provide traders with the opportunity to speculate on price shifts without the requirement for a substantial initial capital.

Yet, it's essential to proceed with care, given their intricacies and potential for swift financial loss. Going ahead, further examination of diverse financial markets provides more perspectives on where these trading techniques can be effectively utilised.

Trading methods: spread betting and CFD trading

Moving from the basics of spread bets and CFDs, we explore the trading methods tied to these financial tools. Spread betting allows investors to speculate on price movements without owning the actual asset.

This method has become a popular way to beat inflation in the UK, as it offers flexibility in both rising and falling markets. Traders can 'go long' if they think prices will rise or 'go short' if they expect them to fall, making it a versatile strategy during uncertain economic times.

CFD trading operates similarly but involves a different approach where traders deal with contracts for difference. They trade on margin, which means they can leverage their positions to enhance potential gains.

However, this also increases the risk as losses can be magnified just as easily as profits. Both spread betting and CFD trading offer opportunities to target inflation-beating investments across various financial markets without needing significant capital upfront.

These methods attract traders looking for efficient ways to protect their savings from inflation while potentially generating returns above the rate of UK inflation November 2023 forecasts.

Different types of financial markets for trading

Traders have several options for financial markets, including shares, forex, indices, commodities, and bonds. Each market offers unique opportunities for beating inflation. Shares allow investors to own part of a company, potentially earning from dividends and price increases.

Forex trading involves the exchange of currencies and can profit from currency value fluctuations. Indices track the performance of groups of stocks, providing a broad market overview and investment opportunities in overall market trends.

Commodities cover physical goods like gold, oil, and agricultural products. Trading commodities can hedge against inflation as prices often rise when currencies weaken. Bonds are loans to governments or corporations that pay back with interest over time.

They offer more stable returns compared to other investments but might yield lower profits during high inflation periods. Investors choose different markets based on their risk tolerance and goals for beating UK's rising inflation rates.

Specific trading strategies and opportunities

Investors keen on beating inflation in the UK can look into thematic investing. This approach targets sectors poised for growth, such as AI, electric vehicles, and ESG initiatives.

2024 shows promise with upcoming IPOs like Brewdog, ByteDance, and Ant Group offering fresh opportunities. These listings present a strategic avenue to diversify portfolios and hedge against inflationary pressures.

For real-time engagement and execution of trades, using modern trading platforms becomes crucial. These platforms facilitate swift decision-making and allow investors to capitalise on market movements effectively.

With the right tools at their disposal, investors can navigate the fluctuating markets of 2024 confidently while seeking out inflation-beating investments in the UK.

Identifying inflation-beating assets

Investors aiming to outpace UK inflation often examine assets acknowledged for preserving or augmenting value over time. Gold, a traditional refuge from inflation, radiates during periods of currency devaluation.

For those aiming for inflation-resistant investments in the UK, overlooking gold is not an option. Commodities also serve a significant role as markers of price fluctuations, making them essential for investors wanting to shield their portfolio from inflationary impacts.

REITs and value stocks present a chance to invest in physical assets and corporations with sturdy earnings respectively, both having the potential to outstrip rising costs. Inflation-linked bonds modify payouts in line with inflation rates, offering an added layer of safety.

Being aware of these alternatives allows investors to make knowledgeable choices about protecting their savings from the effects of the observed inflation in November 2023 in the UK.

Moving forward, a deeper understanding of these investment tools can reveal strategies specifically designed for outpacing the anticipated high inflation rates in 2024.

Investment Options for Beating Inflation

Exploring investment options to combat inflation offers a clear path forward. Each asset, from gold to REITs, provides unique advantages for safeguarding your finances against the rising cost of living.

Gold as a hedge against inflation

Gold shines as a robust hedge against inflation, holding its value even when the purchasing power of currency wanes. Investors often turn to gold during times of high inflation, using it as an alternative to faltering domestic currencies.

This precious metal has historically maintained its worth over time, presenting a secure option for those looking to protect their savings from the erosive effects of rising prices.

Methods like investing in gold exchange-traded funds (ETFs) and exchange-traded commodities (ETCs) offer accessible ways for individuals in the UK to incorporate this asset into their portfolios.

Early forms of credit banking emerged from gold receipts, underlining gold's enduring role in economic systems. As we navigate investment strategies to beat inflation in 2024, including gold among your assets might provide a safe haven against fluctuating market conditions and decreasing currency values.

Commodities as inflation indicators

Commodities like grain, precious metals, electricity, oil, beef, orange juice, and natural gas serve as strong indicators of inflation. Their prices can quickly show when inflation is on the rise.

For example, if oil prices increase sharply, it costs more to move goods around. This leads to higher prices for almost everything we buy.

Investing in commodities through ETFs (Exchange-Traded Funds) and ETCs (Exchange-Traded Commodities) offers a way to protect against inflation. Investors use these tools to directly engage with the market without needing physical stocks of commodities.

As UK inflation rates climb, considering these investment avenues becomes crucial for safeguarding assets against diminishing purchasing power. Next up: how real estate investments align with strategies for beating inflation.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) offer a way to invest in property without having to buy real estate directly. These companies manage income-producing real estate and give investors dividends from these assets.

This strategy can be an effective inflation proof investment in the UK, as rental incomes and property prices often increase with inflation.

Investing in REITs means you get a share of the profits from commercial properties, shopping centres, and office buildings. As inflation rises, so does the value of these investments.

This makes REITs strong candidates for protecting savings against inflation in the UK. Now, let's explore how value stocks and inflation-linked bonds play into this scenario.

Value stocks and inflation-linked bonds

Investors often turn to value stocks during inflationary periods. These are shares of companies trading below what they are actually worth. The appeal here lies in their potential for price appreciation once the market corrects their undervalued status.

UK Index-linked gilts and US Treasury Inflation-Protected Securities (TIPS) act as a safeguard against inflation risk for bonds investors. Their principal increases with inflation, providing a return that keeps pace with rising prices.

Selecting value stocks involves looking at financial health indicators such as debt levels, earnings stability, and cash flow of companies deemed undervalued by the market. For those seeking inflation-proof investments in the UK, adding inflation-linked bonds to their portfolio can offer protection.

These assets adjust their payout based on inflation rates, ensuring returns align closely with any changes in purchasing power over time without eroding savings or investment yields due to rising costs.

Trading and Investing in Inflation-Beating Assets

Trading and investing in assets that outpace inflation requires a strategic approach and keen market insight. Investors find opportunities in various markets, aiming to safeguard their portfolios against the erosive effects of rising prices.

Step-by-step guide for trading inflation-beating assets

Create or log into your account on a chosen trading platform to start trading inflation-beating assets. This simple step sets the stage for you to explore options like spread bets and CFDs, vital tools in beating UK inflation in November 2023.

Next, use the platform's search function to find promising opportunities that match your investment strategy. With inflation proof investments in mind, decide whether you want to buy (go long) or sell (go short) based on your analysis and predictions about the market’s direction.

Select 'buy' if you believe the value of an asset will rise, making it a strategic move against increasing UK inflation rates as of November 2023. Alternatively, choose 'sell' if you expect a decrease, leveraging this position to hedge against potential losses from inflation impacts.

This approach offers a practical way to apply how to beat inflation with savings by actively engaging in markets that traditionally offer protection or growth during times of rising prices.

Step-by-step guide for investing in inflation-beating assets

After exploring how to trade assets that can surpass inflation, the next logical step is to proceed with investing in them. To initiate, sign into your trading platform or form a new account if you haven't created one yet.

This platform will serve as your entrance to identify and acquire assets that can surmount inflation. Search for stocks, Real Estate Investment Trusts (REITs), or Exchange-Traded Funds (ETFs) that have a track record of thriving during periods of high inflation.

Once you spot an asset that aligns with your investment strategy for overcoming UK's escalating inflation rates, select 'buy' on the deal ticket. Take note, this guide concentrates on taking long positions which implies you're investing with the forecast that the asset's value will augment over time.

Pursuing these steps can assist in shielding your savings from UK's inflation effects and potentially expand your financial portfolio despite economic uncertainties.

Historical Examples of Hyperinflation

Looking back, history shows that hyperinflation can wreak havoc on a country's economy. Cases like Venezuela, Zimbabwe, and Germany in 1923 highlight the extreme challenges nations face when currency values plummet uncontrollably.

Venezuela and Zimbabwe's hyperinflation

Venezuela encountered a grave crisis which moved one in three Venezuelans to a state of food insecurity, as documented by the World Food Programme. This crisis had multiple repercussions, leading to mass migration while also displaying the destructive consequences of hyperinflation on a nation's economy and the daily lives of its citizens.

Hyperinflation in Venezuela exhibited the rapid decline an economic situation can experience, affecting millions.

Zimbabwe lived through unparalleled hyperinflation, reaching a peak of 79.6 billion per cent in November 2008. This major financial crash made the Zimbabwean dollar suspend its operations.

This amplified inflation erased savings and rendered basic goods unreachable for the majority of citizens, showing one of the most severe effects of out of control inflation observed worldwide.

Hyperinflation in Germany (1923)

Moving from the recent examples of Venezuela and Zimbabwe, we now explore the hyperinflation in Germany in 1923. This period marked one of history's most extreme cases of inflation.

The Weimar government, caught in financial turmoil after World War I, started printing money rapidly. This action led to prices soaring at an unimaginable pace. For instance, a loaf of bread that cost DEM250 in January reached an astounding price of DEM200,000 million by November.

The currency devaluation was so severe that exchange rates plummeted to one trillion Marks for one US dollar. These figures highlight the dramatic impact hyperinflation had on Germany's economy during 1923, making it a key historical example when studying how to protect savings from inflation in the UK or searching for inflation-beating investments.

Brief mention of the 1973 and 1979 oil crises

The 1973 oil crisis surfaced post the Yom Kippur War, leading to an embargo aimed at nations backing Israel. This occurrence escalated global oil prices by nearly 300%, escalating from $3 per barrel to almost $12 by March 1974.

This abrupt increase in oil prices had a profound effect on the UK's economy and also shaped its method for combating inflation and shaping investment tactics.

Subsequently, the 1979 oil crisis was another significant event that further challenged the UK's capacity to resist inflation. Both these crises underscored the significance of identifying dependable investments to counter inflation and forming policies to lower inflation in the UK.

They act as historical instances encouraging today's investors to find assets capable of weathering such economic turbulences.

Conclusion

Exploring top investment strategies for beating the UK's inflation in 2024 is crucial. Strategies like investing in gold, commodities, and REITs show promise. Trading options such as spread bets and CFDs can be effective but carry risks.

Knowledge of these methods will help manage investments wisely against inflation's rise. Stay informed and act smartly to protect your savings from the impact of high inflation rates next year.

Related Posts

Ask the Expert

Mortgage Brokers

_7779.jpg)